As we approach the release of Ethereum 2.0, it's worth reflecting on how this change will impact miners and where the excess GPU power will be pointed once ETH switches to Proof-of-Stake.

Change is the only constant in this digital world, and the same goes for the world’s second largest cryptocurrency, Ethereum (ETH). Ethereum, which currently uses the ethash algorithm, is gearing up for a major change in governance from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

This piece follows an f2pool livestream discussion about the short and long-term opportunities and challenges presented by the changes to Ethereum. We will explore various insider-views about the consequences of the transition and how it is impacting the crypto-mining industry.

Ethereum not only has a broad developer community base, but also many scientists and researchers support Ethereum. The Ethereum Foundation’s annual R&D expenditure is equivalent to 9 digits of Chinese Ren Min Bi, and people continue to conduct new research and trials. The rich ecosystem built on Ethereum, such as DApps and DeFi, brings a strong network effect.

Chun Wang, Co-Founder at f2pool

As the first mining pool in China to support Ethereum, f2pool will continue to support it for our customers irrespective of any changes. Chun highlights three characteristics of Ethereum that indicate long-term value for our community of miners:

- Ecosystem The current mature ecosystem of Ethereum is already a strong base for the upward-trajectory path.

- Market Value The current approximate market cap of around 20.8 Billion USD is a huge attractor for market confidence and is projected to grow further.

- Scalability One factor that Ethereums has been trying to address for a while is the scalability problem. The future scalability of Ethereum promises that DApps could run cheaply and smoothly, enhancing usability and confidence for the community.

Mining Profits and Fairness

Scalability and ecosystem development were the two main reasons why Ethereum has leant toward GPU mining over ASICs. Focusing on ASICs may ensure better efficiency but some would argue it gives rise to centralization, which is against the goal of ETH.

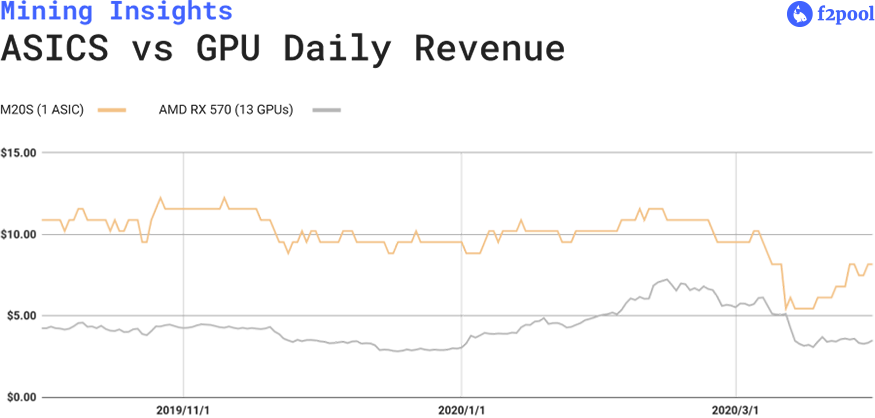

The relative difference in revenue earnings between GPUs is not so far from ASICs and has been relatively stable over time. This characteristic coupled with the slow updation of GPUs keeps the competition table fair for everyone, added Songqing.

There is a key difference between ASIC and GPU supply into the market, in which GPU supply is relatively fixed. This poses a problem for the scalability of mining ETH, and is the reason for thriving secondary market.

Zhang Li, co-founder of Langshen Miners, explained that the unique value proposition offered by GPUs are in its resale market where the used GPUs could be sold at a 20 to 50% premium over purchase cost due to limited supply in the market.

ETH mining is still possible with more affordable and available GPUs rather than expensive and professional ASIC mining machines. This feature promotes fairness and convenient participation that is accessible by the common folk from all over the world.

Zhang Songqing, minerOS Co-Founder

A lucrative resale market, improved quality control and relative insensitivity to electricity prices compared to ASIC machines makes an investment in GPU mining an attractive opportunity.

Way Ahead for PoS

After the transition from PoW to PoS, the landscape will look different but the computing power currently pointing toward the Ethereum blockchain will not go to waste.

ETH and ETC (Ethereum Classic) consistenly produce the same mining revenue, and the consequence of reduction in ETC’s production since the beginning of the year has resulted in ETC to offer higher profits than ETH. On the technical side, in the past two years, ETC has carried out three hard fork upgrades to remain compatible with ETH upgrades.

Higher profits than ETH coupled with several useful DeFi applications such as MakerDAO is a good sign for ETC.

Christian Xu, Asia Community Manager - Ethereum Classic Labs

A hard fork is an extraordinary change to the protocol of any blockchain network. Hard forks make previously invalid blocks/transactions valid. Creating this change essentially creates a fork in the blockchain network: one path follows the new and upgraded ETC network, and the other path continues the old path. Generally, after a while, those on the old chain will realize that their version of the ETC network blockchain is outdated and will quickly upgrade to the latest version.

The market value of other GPU mineable currencies and ETH is very large and ETC is most likely to receive most of the excess computing power. However, it also shows a good development potential for some small market value currencies such as RVN, AE, BEAM, and GRIN.

When asked about the consequences and the influence of GPU miners leaving Ethereum, Chun highlighted that Grin could get a huge boost in terms of mining and community support.

I appreciate Grin’s team, philosophy and community. If I say which coin is the most decentralized, except Bitcoin, I would vote Grin. But, the absolute potential is not yet realized due to the inadequate support from the mainstream exchanges and the community.

Chun Wang, Co-Founder at f2pool

Ethereum 2.0: Miner Strategies

The Ethereum Casper protocol has undergone a long-term exploration, aiming to realize a more scalable network. Though PoW and PoS are the focus of miners in terms of consensus protocols, many teams have conducted various explorations in other consensuses, a good example being Sharding.

Sharding, to explain it in simple terms, is another consensus protocol just as is Proof-of-Work.

In PoW, every single node running the Ethereum network processes every single transaction that comes through it. Although this process ensures high robustness, it falls short in scalability.

Sharding is a different approach to solve this problem in which the entire network is split into a bunch of partitions called “shards” that contain their independent piece of information related to a transaction, for example: state, transaction history etc. This system makes sure that the specific nodes run transactions for only specific shards, allowing the throughput of transactions processed in total across all shards to be much higher than having a single shard do all the work as the main network does now.

Though the current Ethereum proposals can solve certain challenges, it is still far away from the fundamental improvement. The upcoming stage 0 will introduce staking, but for miners to act as verification nodes may be difficult.

Stakefish, a staking arm of f2pool, has actively participated in many PoS networks and has accumulated rich experience in participating in PoS networks. At present, the latest version of Ethereum is still to be tested. Miners who plan to become nodes should avoid problems such as offline and double signing that may be encountered when participating in the PoS network. They can work with professional verification nodes for technical support, added Chun.

To address the sudden transition to PoS panic, no community would convert such a high market value network to PoS consensus in a short period of time. It will be gradual, using high tolerance modes throughout the conversion, during which miners can still carry out PoW mining.

For Ethereum 2.0 with PoS consensus, GPU miners naturally have the advantage of being nodes. One can choose to hold ETH mined on the Ethereum PoW chain and make nodes on Ethereum 2.0 to earn network rewards.

The development roadmap has been slow and rocky since the early days of Ethereum. There has been plenty of success and value created on the chain, and it will be interesting to see how the next steps play out. ETH 2.0 is currently scheduled for June 2020, we’ll be keeping an watchful eye on how this impacts the miners in our community.