With the London hardfork anticipated for August 4th, we thought it would be pertinent to go over some key facts, reminders, and clarifications for EIP-1559.

Notes

EIP-1559 is a “transaction pricing mechanism that includes fixed-per-block network fee that is burned and dynamically expands/contracts block sizes to deal with transient congestion.” The goals are user experience from a perspective of transaction fee predictability. Certainty over what transaction fee to pay in order for your transaction to get through can be filled with uncertainty and oftentimes users end up paying far more (up to 5 times!) than they need.

The goals of user experience on what prices to pay for transactions are important for users and especially infrastructure services providers like wallets, exchanges, and applications. It is important to note that there is much nuance to the changes that are being implemented by EIP-1559 that may differ from popularized and simplified monetary policy claims that have taken the community by storm.

Quick details!

- All three testnets Goerli, Ropsten, Rinkeby have implemented the London Hardfork including EIP-1559. The Kovan testnet will follow after the mainnet upgrade because of OpenEthereum’s deprecation post-London hardfork.

- Desired user experience on transaction fee predictability is the focus of EIP-1559

- Fee burns and miner revenue is a long term relationship

- EIP-1559 nuance is important in tempering expectations from theory to reality

Some key changes

User experience improvements are the crux of the EIP-1559 focus. In particular, it is attempting to make fee markets more predictable. Pre-EIP-1559, the fee markets looked like this: fixed reward + fee, in a first-price-auction mechanism. The main problem was that fees were very high if the network was congested. These affected the user experience and efficiency of the network.

Post EIP-1559, there will be a fixed reward + base fee + tip structure for users who use Ethereum. Everyone will pay the same amount of base fee and can also have familiar transaction prioritization via tips.

How network parameters will be changed?

Here are some quick figures for you.

Gas limits will be doubled from the current 15 M to 30 M. This is not set to make the daily block size larger but gives the network the possibility to double capacity to ease any congestion. The network will target the gas limited to currently 15 M which will be 50% of the post EIP-1559 gas limits.

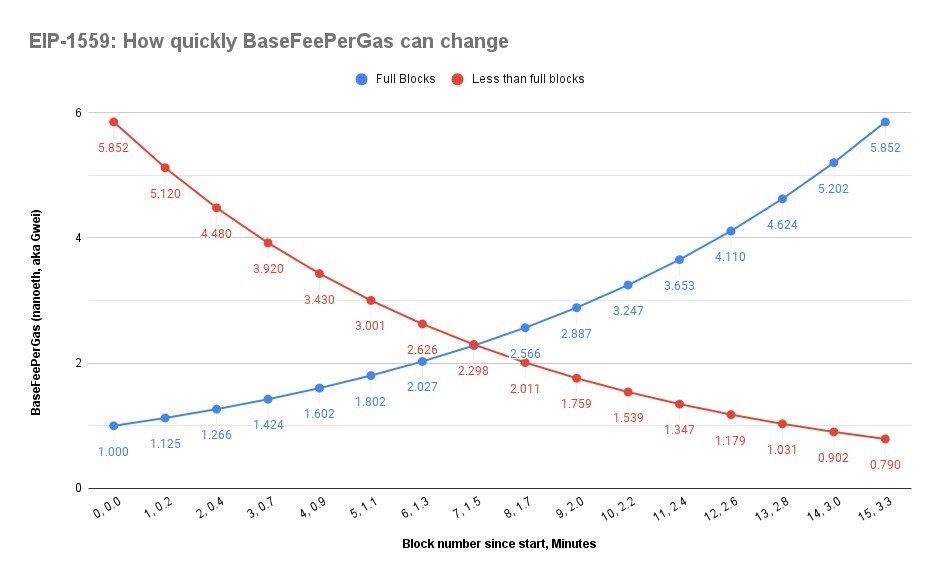

Basefee. The basefee is the same for each transaction per block, and will be adjusted from block to block. These are adjusted by rules set in the protocol and will be burned. It can increase or decrease up to 12.5% depending on how full the block is relative to the previous block. When it is 100% full, it will increase by 12.5%. If 50% full, the basefee will remain the same when it is 0% full fee drops by 12.5%.

Tips, or the priority fee, can help people to speed up transactions. These will be triggered when demand exceeds a 100% full block size. Users can also set a cap to show the maximum amount they are willing to pay overall and get the unpaid fee as a refund. BASEFEEs are also required when you choose to add a tip.

What will basefee change look like?

We can also take a look at the change in speeds according to Trenton Van Epps’s simulations modeling different scenarios. At post-London, the baseFeePerGas (bFPG) starts at 1 Gwei and takes ~3.3 min to ~6x. This twitter thread shows more scenarios. The basefee drops slightly faster than it rises.

What should miners take heed to concerning post-London revenues?

A concern miners may have is regarding drops in fees. The degree of potential fees reductions is estimated to be less than 30% — it is certainly not a fee “halving”. This fee revenue reduction measured in ETH does not necessarily mean revenue decreases!

Reason 1) what directly affects how much ETH is mined is dependent on network difficulty and hashrate scale, Reason 2) as a miner, we measure revenues in fiat value converted from ETH, so it depends closely on the market. Finally, the market is driven by the adoption of the network, with DeFi, DEXs, and a variety of dapps.

What’s more, miners will still get potential MEV profit post-London hardfork.

How will MEV be affected by EIP-1559?

MEV markets will still exist. There will always be arbitrage opportunities from the markets. DeFi traders seek to change and pay fees to get their transactions included earlier than others to capture significant financial opportunities and events. f2Pool supports Flashbots MEV that can bring value while still making MEV benign through Flashbots’ tooling suites and incentivization mechanisms for coordination among the various stakeholders.

However, how the percentage of the MEV income constitutes the total income will be different, due to structural changes. Kristof Gazso (Nethermind) and Alejo Salles (Flashbots) dive in-depth to MEV and EIP-1559.

What is the community most excited about by the fee change?

Let’s get back to basefees. It will introduce deflationary aspects to Ethereum. The network will begin burning tokens as a part of the system’s transaction fee market mechanism.

If networks with capped supply aim to make sound money, EIP-1559’s burns have rallied a community towards monikers of Ultrasound money!

Concerning “ultra sound” inflation, Tim Beiko shared that at the current gas limit, the PoW chain would be deflationary with a base fee of ~150 Gwei, and the PoS chain, with the current daily issuance, will be ~11 Gwei. Check out this ultrasound.money page and play around with adjusting staking amounts on eth2, average basefees, and the merge dates to see how the curve changes in response to those variables.

Do I need to do anything as a miner with f2pool?

As a miner in the f2pool family, you do not need to do anything specifically for the London hardfork. We will prepare our infrastructure and Flashbots MEV to guarantee your income. Happy mining!