Ethereum’s transition from Proof of Work to Proof of Stake has been planned since the earliest days of the network—which means Ethereum miners have been apprehensive about the future of their industry since the very beginning.

With the successful launch of the Beacon Chain and Phase 0 of Ethereum 2.0, we wanted to share some insights on what the future of Ethereum 1.0 mining will look like.

In short: There are still plenty of rewards to chase, and there will be for a long time!

What’s next for Ethereum?

On December 1, 2020, Ethereum’s Beacon Chain successfully launched. For now, the Beacon Chain is an entirely separate blockchain from the Proof of Work Ethereum chain. Eventually, they will merge into Ethereum 2.0, and Proof of Work mining will be replaced with a Proof of Stake system.

What does this mean for the future of the PoW chain, Ethereum 1.0 (Eth1)? As an Ethereum miner, where do you stand?

The first thing that’s important to realize is that Eth1 is expected to continue to run normally, with no major changes to the way mining is conducted, for at least a year.

It’s also important to understand that Eth1 is still a critical component of the Ethereum ecosystem, and that the eventual migration to Eth2 cannot take place without it.

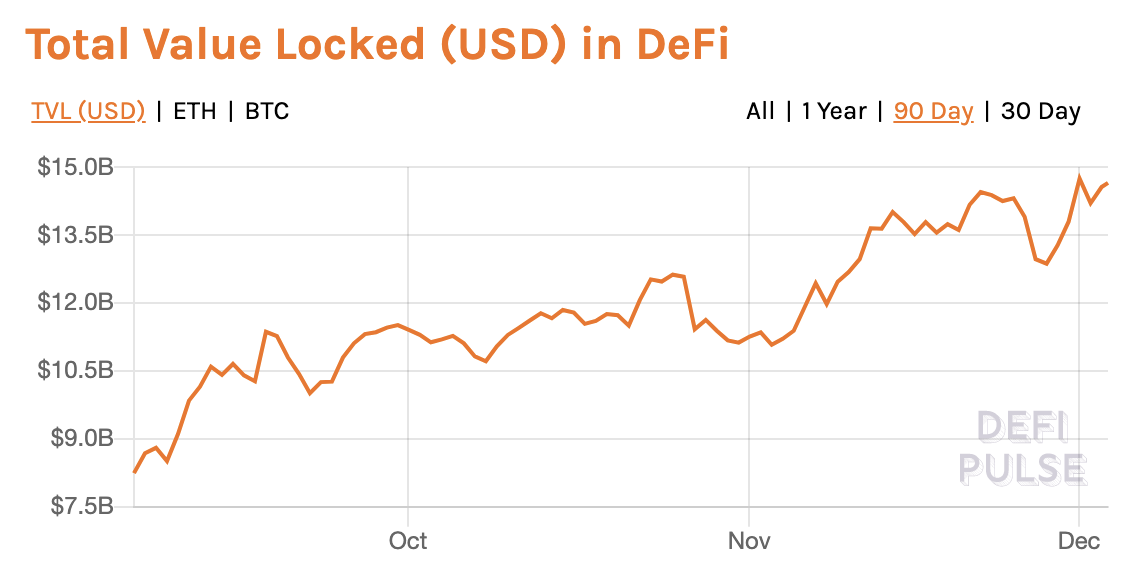

For now, almost the entire ecosystem of Ethereum dapps, wallets, and other products are built on Eth1, and this will remain the case for a long time. Ensuring that Eth1’s sprawling multi-billion-dollar DeFi infrastructure is able to make the transition successfully will be a major undertaking in itself.

Source: DeFi Pulse

Source: DeFi Pulse

Eth1 must be in a robust, well-functioning state to be successfully merged into Eth2. It also needs to become stateless, a major upgrade that will require work on the EVM, a block witnessing mechanism, and other non-trivial modifications.

For these reasons, Eth1 will continue to be actively developed and upgraded, and miners will not be faced with performance issues or an increase in storage requirements.

In contrast, the next phases of Eth2 are still in the research phase, and the timeframe for their development remains uncertain. Until the full transition finally takes place, Eth1 will continue to be powered and secured by the miners.

Will Ethereum mining still be profitable?

Now that we know Eth1 isn’t going anywhere any time soon, let’s examine some of the ways mining revenue could be affected by the development of Ethereum 2.0.

There are two main factors to look at when analyzing Ethereum mining revenue: the block reward and transaction fees.

The block reward

The current block reward was fixed at 2 ETH per block by a hard fork that took place in February 2019 with the aim of reducing inflation and maintaining ether’s purchasing power. Because Ethereum does not have a block reward reduction mechanism built into the protocol, the block reward can only be changed with a hard fork.

Does this mean the block reward might decrease again?

Theoretically, another block reward reduction is a possibility. Ethereum Improvement Proposal 2878, which seeks to reduce inflation by reducing the block reward from 2 to 0.5 ETH, has been under discussion since it was proposed back in August. However, inflation has already been addressed with Serenity, and the proposal doesn’t seem to be gaining much traction.

Transaction fees

Fueled by the DeFi boom, transaction fees have accounted for a large proportion of miner revenue in recent months.

Source: Coinmetrics

Source: Coinmetrics

This tends to happen when the network is affected by serious congestion, which causes gas fees to spike as users pay more to get their transactions to the front of the line. Under normal conditions, most miner revenue is derived from the block reward, which has been the primary source of miner revenue since the network’s inception.

Ethereum Improvement Proposal 1559 suggests modifying the dynamics of the Ethereum fee market to mitigate certain issues with user experience that arise during times of high congestion. If EIP-1559 passes, the sky-high fees miners often receive during these periods will be reduced. As we have noted, however, this should not seriously affect mining revenue in the long run, and the proposal is still being debated.

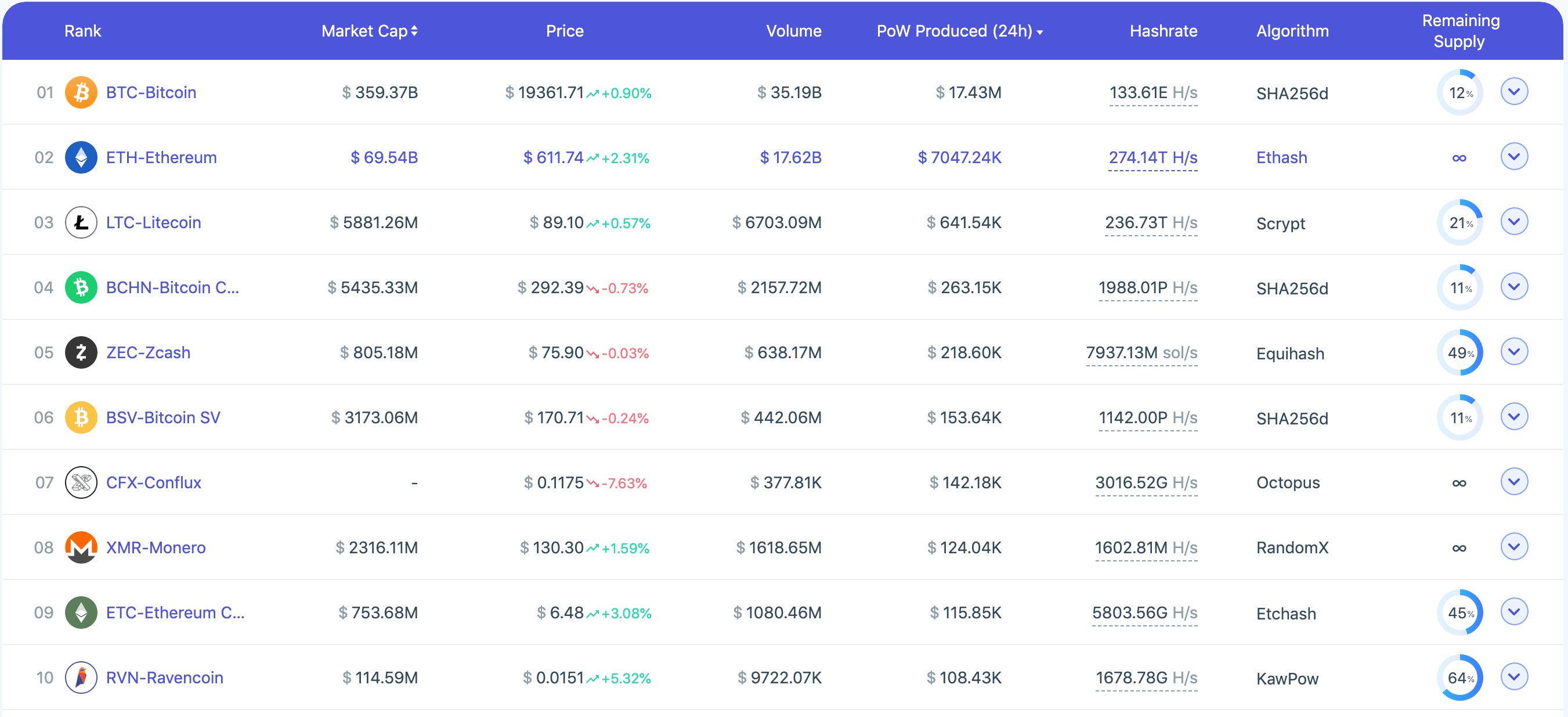

The market potential of Eth1 mining

By the fiat value of daily rewards issued, Eth1 is second only to Bitcoin and produces more than 10 times as much value as Litecoin, the third-place cryptocurrency by this metric.

This situation is not likely to change any time soon. Multiple sources, including Ethereum creator Vitalik Buterin, have stated that the issuance rate will remain stable at 4.7M tokens per year for the foreseeable future.

Highlighting a comment I made in the reddit AMA yesterday that got buried but I think expresses something important: pic.twitter.com/NR2Y7GWY9U

— vitalik.eth (@VitalikButerin) November 19, 2020

As of the publication of this article, Ethereum mining revenue is $0.038 per MH/s.

Source: Coinmetrics

Source: Coinmetrics

What’s next?

Now that we can rest assured that Eth1 mining will be a profitable option for at least another year or two, let’s look at some of the ways you can maximize your revenue.

Upgrading your hardware

Upgrading hardware is probably the most common way to maximize mining revenue. Tried and true methods like upgrading the eight memory units of each of your GPUs from 512MB to 1GB remain effective.

AMD cards like the RX470, RX480, RX570, and RX580, which were made obsolete after the DAG file size increase, can be brought back to life with considerably improved performance with a series of hardware modifications.

Software upgrades and mining firmware

Some stock GPUs have built-in limits to how much memory they can utilize that are lower than the actual amount of physical memory they have. The P104, for example, is limited to using 4GB, but a software update can enable it to utilize the full 8GB it contains.

You’ll also want to try to improve the performance of your devices by upgrading to specialized mining firmware aimed at boosting hashrate and lowering energy consumption.

New ASICs

New ASICs with much higher hashrates than existing machines could enter the market.

Should I stake my ETH?

Every ETH holder should consider staking as a way to put their ETH holdings to work. The staking reward rate is expected to range between 2% and 20%, and 32 ETH is required to spin up a validator. Staking pools offer a solution for those who want to stake other amounts.

Please note that ETH staking is not risk-free. Software or network bugs, penalties and slashing, and price volatility can all affect your returns.

These risks may be mitigated by staking with a service provider with a strong track record of providing staking services on other Proof of Stake networks.

One example is stakefish, which offers a non-custodial platform for staking your ETH without giving up control of your funds and supports 10+ other Proof of Stake networks. Currently, 9% of staked ETH has been staked with stakefish.

Keep calm and carry on mining

Eventually, Eth1 and Eth2 will merge, and Proof of Work Ethereum mining will no longer be an option. But that time is still in the distant future, and there are still plenty of rewards left to earn as an Eth1 miner.

Taking advantage of hardware and software upgrades can help you maximize your earnings. We suggest reviewing our Ethereum mining guide to optimize your set-up.

Join us on our social media channels to keep updated with the latest mining developments!

And most importantly: Keep calm and carry on mining!

Website: f2pool.com

Blog: f2pool.io

Twitter: @f2pool_official

LinkedIn: f2pool

Reddit: /r/f2pool