The South Korean government recently introduced regulatory clarity and practical support for cryptocurrencies. Crypto projects are tapping into existing user bases to establish retail demand.

The mix of retail demand, government backed programmes and regulatory clarity indicates that South Korean crypto projects are looking ready for takeoff.

This piece follows an f2pool livestream discussion about the implementation and adoption of blockchain projects in South Korea. With the input of several CEOs and industry leaders we’ll explore the current state of play in Korea and what the introduction of new regulations means for the future of the industry there.

Crypto Adoption in South Korea

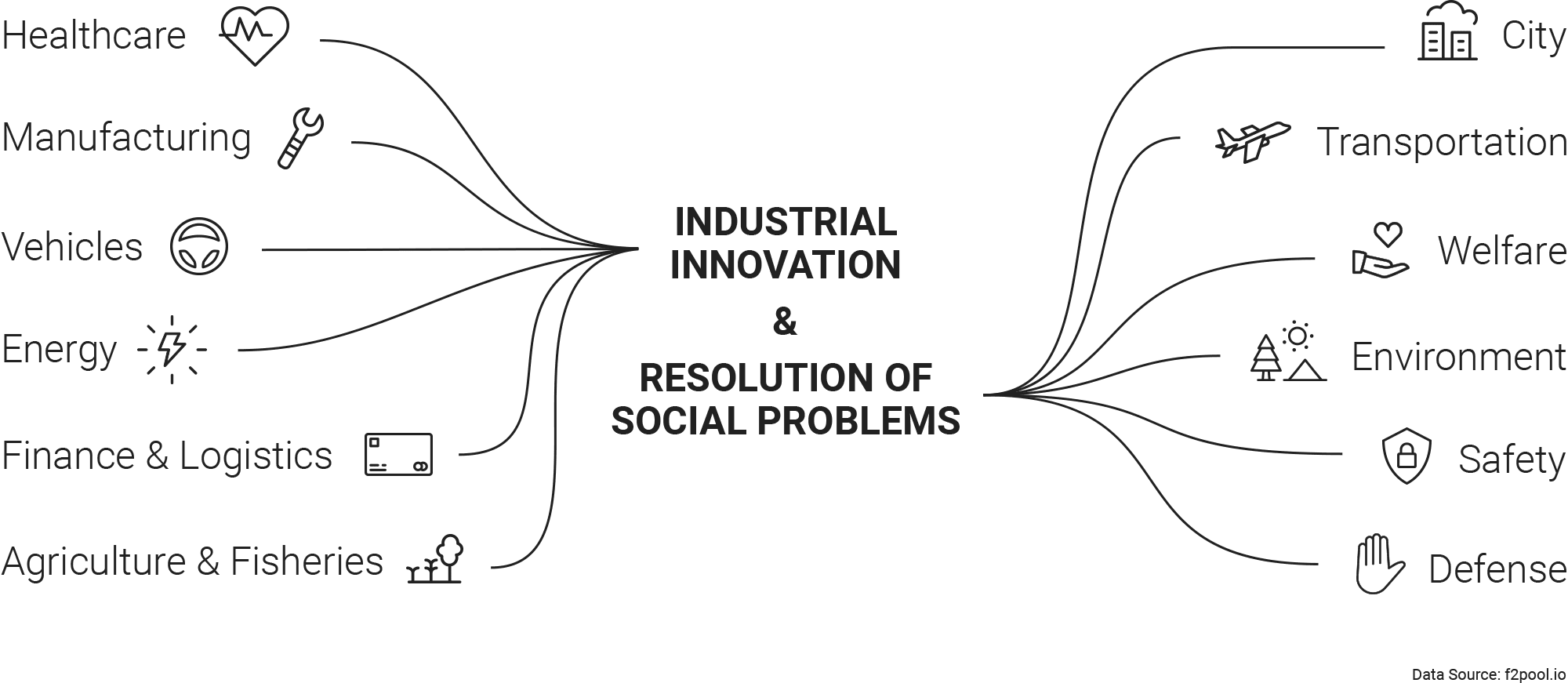

South Korea, as a nation, has been actively promoting the key industries that it believes will lead the fourth industrial revolution. The industrial innovations and social resolutions include solutions like AI and blockchain technology.

Source: https://www.4th-ir.go.kr/home/en#about_4thir

Cryptocurrencies, and the tech that supports them benefit from this national support. Korea has one of the world’s fastest internet speeds and penetration rate is high. Korean CEOs and CTOs expect the country to make more progress in this industry than other Asian countries. To encourage adoption, the Korean government recently established even clearer regulations for crypto and crypto exchanges.

Also, like the central banks in China and the US, the Bank of Korea is researching its own Central Bank Digital Currency (CBDC). At the same time, many of the large Korean conglomerates are exploring blockchain solutions for sectors like identification services and in gaming where transaction costs for in game items is a big enough pain point for them to target.

Barriers to Adoption

As with crypto adoption globally, as Joseph Hung, Director of Market Strategy at Klaytn, explains: Korean founders face similar barriers to user adoption.

- Lack of user base

- Bad UX

- Few real-life use cases

- Scalability

Lack of user base

Many of the crypto projects that popped up in the 2017 ICO craze struggled because they were not able to tap into an established user base. Decentralized messenger apps like Status would need an enormous shift in user behaviour if their platform is ever going to take off. Instead Korean projects like Klaytn are tapping into existing communities by integrating their products into popular platforms like KakaoTalk messenger which already has a monthly active user base of 50M+. The Klaytn Governance Council boasts a combined user base of over 700M people worldwide.

Bad UX

The lack of technical know-how and security best practices among casual users is another barrier to mass adoption. In Korea, where the interest is mainly in the form of B2C products and retail traders, developers are trying to solve some of the biggest problems like keeping a safe record of private keys and replacing the need for sharing public keys through a technically challenging UI. The Klip wallet has removed the need for either, where tokens can be sent from within KakaoTalk with a similar user experience of simply sending a message. It will be interesting to observe whether this kind of handholding leads to a better understanding of Bitcoin and blockchains as a whole, or whether we will reach the point where users don’t need to think about whether they are interacting with a blockchain at all.

Few real-life use cases

Apart from Bitcoin, and more recently ERC-20 DeFi tokens, real life use cases for blockchain and crypto projects have been few and far between. In Korea, the majority of interest has been for trading and speculation. In particular for retail investors who were attracted to the opportunities presented by cryptocurrencies in contrast to the more controlled, and less volatile opportunities of the Korean stock exchange. NFTs may prove to be the next use case that creates momentum in South Korea, with large conglomerates and games studios launching collectible tokens. Korean airline companies are also exploring mileage coupons.

Scalability

In general, f2pool sees layer two solutions as the way forward for increasing the number of transactions that can be handled by a blockchain. However some blockchains, like Klaytn, boast of being able to reach 7,000 TPS, and target one second confirmation times.

Korean Investor Appetite

As Do Kwon, Co-Founder & CEO at Terra, reports, Korean retail investors have limited options to profit from the Korean stock market and that has made cryptocurrencies an attractive alternative for them in the past few years.

The value of all the public traded equities on the market in Korea is less than the market cap of a single US company like Apple. He explains that there are structural reasons why the equity market in Korea can’t take off. Whenever the market gets particularly volatile, the government steps in and changes certain rules such as 33% or more of the entire market cap is consumed by one company or industry. This limits volatility and reduces the opportunities for large returns.

In the past five to ten years we’ve seen more unicorns coming out of Asia. The problem, shared by many Asian countries including Korea, is that the markets are not big enough for these unicorns to go public or not efficient enough for them to stay there.

Baek Kim, VC at Hashed

Many times, Korean companies move to Delaware or list themselves on the London Stock Exchange or in Hong Kong. Blockchain projects come with the promise of giving retail investors the opportunity to participate in the growth of private companies. In Korea, the investor appetite for this is high.

Stablecoins in Korea

Stablecoins are a niche, yet powerful, category within crypto. Terra.money, is a stablecoin project based out of Seoul. Their founder, Do Kwon, explains that while the initial use case of stablecoins that led to the growth of Tether, i.e. exchange arbitrage, is now expanding:

Corporate stablecoins like USDC, Paxos and the Gemini dollar try to improve upon the reputation and institutional adoption of Tether. Whereas coins like Maker DAO’s DAI try to solve the centralization issues inherent in the corporate coins. Terra is aiming to offer a stablecoin that is particularly attractive to the commercial sector.

The project can be compared with Facebook’s Libra. While Libra is perhaps more focused on social payments, both projects are relying on established user basers to increase early adoption. They also both create privacy concerns.

A public ledger of transactions is great for transparency but for merchants considering to implement Terra as a form of payment there are still unanswered questions about how to keep business intelligence and user behaviour private. Point of sale data is particularly valuable in the ecommerce sector and it’s unlikely that businesses will want that information publicly available.

What is stable?

One thing to consider with stablecoins, is just how stable they actually are. A USD stablecoin is not particularly stable in the eyes of someone who lives in Indonesia. They do not have regular experience of paying for things with US dollars and their day to day experience of value is not measured in USD. For merchants that operate across multiple countries, if they can have interoperable stablecoins demarcated in different fiat currencies, they would have an advantage in the enormous savings in exchange and settlement fees. Removing those costs can save as much as 9% of the transaction value. Paypal, for example charges upto 4.0% on top of the exchange rate for certain currencies.

Crypto Regulation in Korea

In Korea, regulated cryptocurrencies and exchanges are on the rise, while native crypto applications have weakened. Especially since March 2020, when the Korean government was able to pass a bill as an amendment to their Financial Act that gives a clear regulatory framework for crypto. Baek Kim notes that the obvious motivation for governmental regulation is to implement taxation. VCs like Hashed, and their portfolio of blockchain companies, are working directly with the authorities to execute on these changes.

In the past two years, there has been a slow decrease in trading and investor volume in the Korean market. This was a result of many exchanges removing fiat onramps for retail investors, but now with the change in law many of the leading banks are growing in confidence when it comes to dealing with crypto assets and crypto asset managers. Now that cryptocurrencies are legalized, the focus of the regulators will shift to topics such as KYC and AML compliance.

With Korean conglomerates building products specifically targeted at their existing user bases, the heady mix of retail demand, government-level encouragement and regulatory approval suggests that South Korea is set for increased growth in the crypto and blockchain sectors.