In this article, we’ll highlight the most impressive mining moments of 2020 and discuss the outlook for crypto mining in 2021.

The time has come to look back on 2020 and to look forward to a new year. The unexpected changes brought about by the pandemic affected everyone and everything, and crypto mining was no exception. It was a tough year, and miners really had to live out the true meaning of “survival of the hodlers.” Leaving the machines on and keeping the hashrate flowing turned out to be the golden rule for staying profitable in 2020.

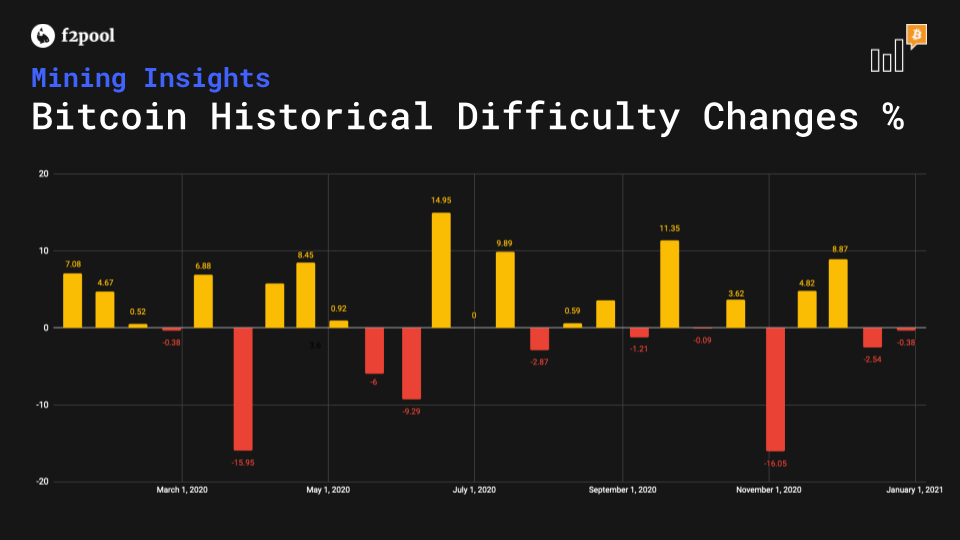

The year in mining difficulty: Good times and hard times

The year 2020 tested who the real hodlers are—and rewarded them. Tracing mining difficulty is a good way to review the state of mining throughout the year, as it shows how miners have had to arrange their hashrate to maximize profits or minimize losses.

There were 27 difficulty adjustments on the Bitcoin network in 2020. Here are eight of the most important, corresponding to particularly good or especially tough times for miners.

| Time | Difficulty change | Related event | Description |

|---|---|---|---|

| 2020-03-26 | 📉 -15.95% | Black Thursday on March 12 | Price drops below machine turn-off price |

| 2020-05-20 | 📉 -6.00% | Bitcoin halving on May 11 | Mining costs double |

| 2020-06-04 | 📉 -9.29% | Post-halving | Price remains at the same level after the halving; wet season hardware migration begins |

| 2020-06-17 | 📈 +14.95% | Wet season starts in late May | Cheaper hydropower prices significantly reduce costs |

| 2020-07-13 | 📈 +9.89% | Wet season continues | More hashrate arrives |

| 2020-09-20 | 📈 +11.35% | New hashrate floods in | S19 Pros are switched on; altcoin hashrate switches to BTC |

| 2020-11-03 | 📉 -16.05% | Wet season ends | Machines are turned off for transfer to mining farms that offer lower electricity costs |

| 2020-11-29 | 📈 +8.87% | Miners finish hardware migration | Machines come back online |

Black Thursday on March 12 was the main reason for the significant difficulty decrease two weeks later.

During this time, only a handful of the most powerful mining machines were profitable. Hashrate dropped by 20% to less than 100 EH/s.

In these circumstances, many miners choose to turn off their machines as soon as they are no longer profitable and turn them on again after the price goes up sufficiently. In this case, miners who were willing and able to keep mining benefited from the newly lowered difficulty because they were able to mine more bitcoin.

The Bitcoin halving and the hydro season mining hardware migration in southern China led to consecutive difficulty decreases on May 20 and June 4. After the halving, price levels remained the same while mining costs doubled. At the same time, machines were being turned off to be relocated to mining farms with lower electricity costs.

Once the hardware migration was finished, the June 17 and July 13 adjustments resulted in big difficulty changes as machines went back online running on cheaper hydropower, significantly reducing costs.

In September, the first round of new ASICs was delivered, while hashrate flowed into the Bitcoin network from the altcoin crash, leading to a big difficulty increase on September 20.

As the wet season ended and cheap hydropower was no longer available, Chinese miners migrated their rigs north in search of lower electricity costs, which led to the difficulty decrease on November 3.

Looking back, it’s clear that Bitcoin’s mining difficulty is heavily influenced by seasonal changes in China, where so much of the total hashrate is concentrated. Hardware migrations triggered by these changes were the primary factors behind the most dramatic difficulty adjustments in 2020.

Understanding these seasonal changes means you can prepare for them in advance. Stable miners who keep their rigs running and weather the short painful periods tend to succeed. The golden rule is “Mine, stack, and hodl.”

Hashrate, hardware, and unexpected rewards

Bitcoin and ASICs

The 2020 mining industry exceeded expectations. At the beginning of the year, the total hashrate on the Bitcoin network was not expected to change much due to the halving and to limited production of new mining machines. When COVID-19 came along, the landscape looked even bleaker.

But some still saw opportunity. As f2pool co-founder Discus Fish said several times in online and offline events at the beginning of the year, “In 2020, miners can achieve excess earnings if they can grasp the resources and opportunities available in the current hashrate market.”

This turned out to be true if you mined continuously without quitting. Mining profitability results from a favorable combination of network difficulty and price. A lower price can bring higher revenue if difficulty drops with it. When many turned off their machines during Black Thursday and similar events, for example, those who kept mining were able to mine more coins when difficulty subsequently dropped.

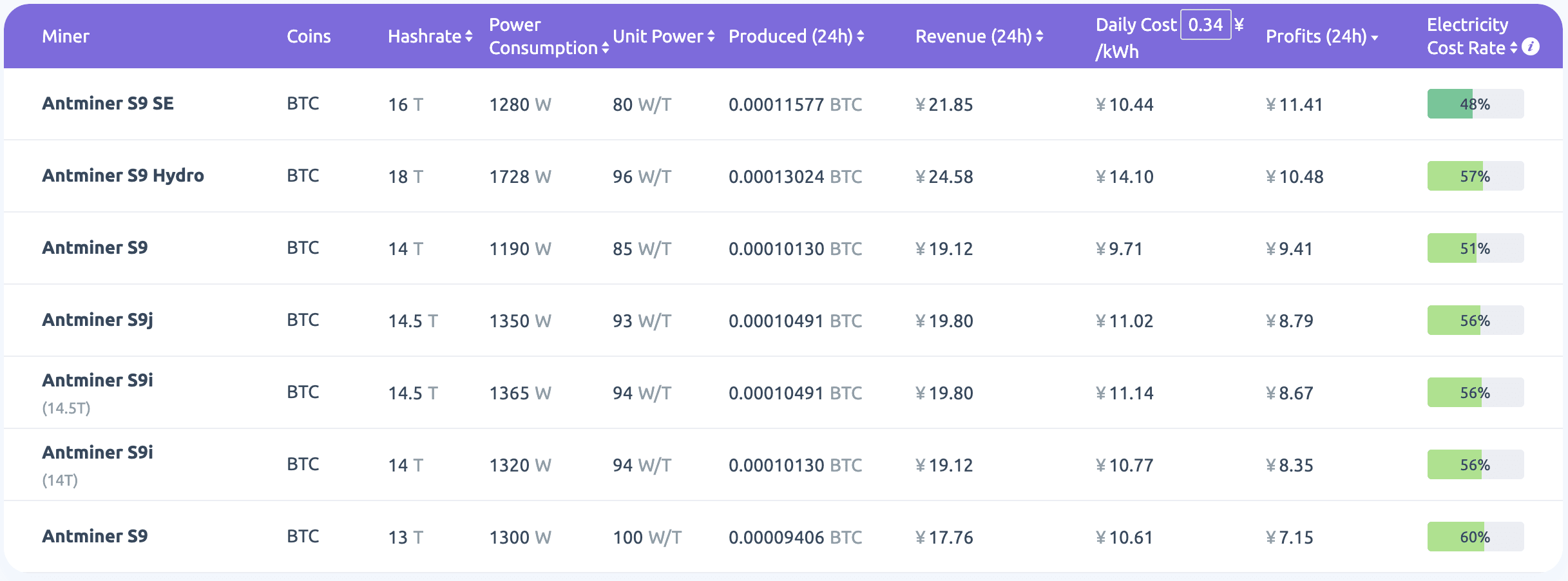

After reaching the turn-off price three times, old-gen machines, specifically those with 16nm chips with unit power consumption higher that 80 watt/T, were still able to mine profitably.

Source: f2pool Popular Miners page Accessed: 2020-12-31

These operational expenditure (OpEx) scenarios show the costs of mining 1 BTC with an Antminer S9. On days when the BTC price drops below the “Broke Baseline,” the machine won’t make a profit at that electricity price.

With machines like the S9 remaining profitable for much of the time, the secondary mining machine market is thriving. With hashrate fully utilized in multiple generations of miners, the Bitcoin network became more secure than ever before. A bull market not only benefits hodlers, but also strengthens the security of the network.

Mining with f2pool

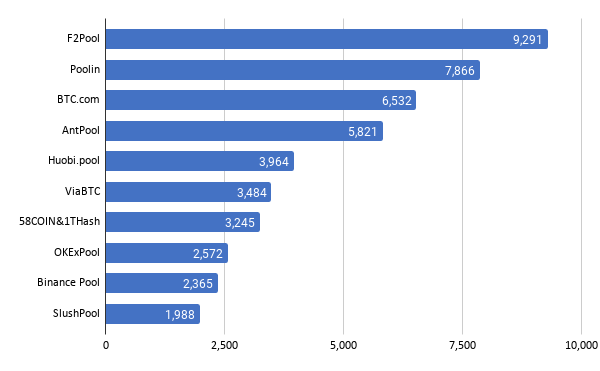

f2pool miners produced a huge percentage of Bitcoin blocks in 2020 to help the network reach its highest ever level of security.

Bitcoin blocks per pool for 2020 (Top 10) Source: btc.com

f2pool produced about 9,300 Bitcoin blocks in 2020, accounting for 17.52% of the total blocks produced and making us the number-one block producer of the year.

We also had some luck during the halving: f2pool miners produced both the first 12.5 BTC blocks 4 years ago, and the last 12.5 BTC block in 2020.

The final Bitcoin block with a subsidy of 12.5 BTC was mined by @f2pool_official and contained the following message in its coinbase transaction:

— Jameson Lopp (@lopp) May 11, 2020

🐟NYTimes 09/Apr/2020 With $2.3T Injection, Fed's Plan Far Exceeds 2008 Rescuehttps://t.co/9dtTrC8YH6

Ethereum and GPUs

Two main factors had Ethereum miners worried at the beginning of the year: the DAG file size approaching 4GB and the transition to Proof of Stake. Luckily, the bull market was quick to erase these anxieties.

DeFi brought the first unexpected wave of profits to Ethereum miners due to the huge transaction fees users were paying to get their transactions prioritized in the highly congested network.

| 2019 | 2020 | Variation | |

|---|---|---|---|

| Avg daily fees in ETH | 511.43 | 4017.23 | 785.49% |

| Avg daily fees in USD | $94,748 | $1,431,343 | 1510.68% |

| Yearly fees | $34,580,077 | $478,107,560 | 1382.61% |

Source: coinmetrics.io Accessed: 2020-12-31

Most of the FUD in the Ethereum mining community died off, and many people bought GPUs to supplement their rigs. The atmosphere had quickly changed from “wait and see” to “get on board.” Since the latest DeFi hype cycle, hashrate has nearly doubled.

The increasing DAG file size made many miners using GPUs with 4GB memory consider throwing in the towel. On December 25, the DAG file finally reached the long-anticipated 4GB, but contrary to expectations, some mining software enabled them to continue mining, though not without a hashrate sacrifice. Thanks to this, a large chunk of the hashrate that initially switched to other networks is gradually returning to Ethereum.

Progress on staking-based Ethereum 2.0 was the other major factor casting doubt on the continuing viability of PoW Ethereum mining, with many miners worrying that Eth1 mining would fall by the wayside. In fact, Eth2 has led to a major boost in the Ethereum price and confidence level, attracting an increase in hashrate instead.

Mining with f2pool

2.3M blocks were produced in the Ethereum network in 2020, worth a combined total of $1.726M at the current Ethereum price. f2pool miners mined about 553k of these blocks. Currently, f2pool miners are securing 10% of the Ethereum 1.0 Proof of Work network, ranking in the top three block producers.

We are closely following Eth2 developments to share our knowledge and find ways for miners to participate. One option for hands-off, non-custodial staking is stakefish, founded by f2pool co-founder Chun Wang and operated independently. stakefish is currently securing about 7% of all staked ETH.

40+ PoW networks

f2pool supports mining for more than 40 Proof of Work coins.

Our PoW Rankings can help you understand the stable growth of the PoW world and its dominance in crypto. Bitcoin, the first and biggest crypto network, currently accounts for 70% of the total crypto market capitalization. f2pool was the number-one Bitcoin block producer and a major contributor to many other networks in 2020.

| Network | Latest hashrate | f2pool share | f2pool ranking |

|---|---|---|---|

| Bitcoin | 143 EH/s | 17.9% | 1 |

| Ethereum | 285 TH/s | 10.6% | 3 |

| Litecoin | 282 TH/s | 11.2% | 4 |

| Zcash | 8.3 GSol/s | 21.2% | 2 |

| Nervos | 13 PH/s | 51.2% | 1 |

| Monero | 1.8 GH/s | 7.7% | 5 |

| Grin | 15 KGps | 10% | 2 |

| Handshake | 5 PH/s | 38.4% | 2 |

Source: miningpoolstats.stream Accessed 2020-12-31

f2pool miners contributed a lot to some of 2020’s most promising emerging networks, including Nervos (30% mined by f2pool, rank 1), Handshake (30% mined by f2pool, rank 2), and Conflux (39% mined by f2pool).

With a mature product, stable servers, and miner-friendly payout schemes (many new pools are set to PPS, which provides more stable returns), we have been excited to see a lot of organic growth in our user base all over the world.

Open questions for 2021

Is there really a halving effect?

Bitcoin keeps hitting new all-time highs due to a combination of institutional money flowing in—with firms like Grayscale buying up huge shares of newly mined Bitcoin—and the inflation of the US dollar.

But is there also a “halving effect” that positively influences the Bitcoin price every four years when the block reward halves, contracting the supply of newly minted coins?

Looking at the second halving in July 2016, the bitcoin price grew from about $600 to $2,600 that year, a more than 4x increase. Zooming out to compare to the new ATH set at nearly $20,000 at the end of 2017, we see an increase of about 33x. Could this be partially the result of a long-term “halving effect”?

Setting the $9,000 bitcoin price on the day of the third halving as a new starting point, if the trend continues, together with the possibility of a fiat inflation crisis and development progress such us the activation of Taproot, bitcoin may be only at the beginning of a long upward price trajectory.

Bitcoin is not the only network that undergoes block reward reductions: 17 other coins underwent some form of block reward reduction in 2020. How will the crypto world look next year if the “halving effect” not only exists but also applies to other networks?

Will ASICs dominate Ethereum mining?

Two weeks ago, we unboxed a powerful new Ethereum and Ethereum Classic ASIC miner, the Linzhi Phoenix, which has been the subject of a lot of heated discussion in the mining community.

Wilson Guo, the founder of Panda Miner, recently shared with f2pool his observations of the ASIC trend in Ethereum mining. “There are at least six teams I know of that are working on new ASICs, including Bitmain. Perhaps as soon as May, many news ASICs will come to the market.”

As Ethereum has continued to grow, developing ASICs for Ethereum mining has become more lucrative. At the current price level, costs can be covered in three months or less.

But this doesn’t mean there are no risks involved in developing and mining with ASICs. For one thing, ASICs are less resilient to algorithm changes, such as a switch to ProgPoW. For this reason, GPU mining is likely to remain popular, and GPU devices should retain high resale value. Guo believes that “Ethereum mining will be interesting next year. Perhaps GPUs and ASICs will both account for 50% of Ethereum hashrate.” Other concerns, such as the difficulty bomb and fee and block reward adjustment discussions, will also play a role.

What will the distribution of hashrate look like?

With more new-gen machines gradually coming to market, hashrate and difficulty are likely to continue on a long-term upward trend.

In 2021, more advanced ASICs released in 2020, such as the Avalon A1246, Whatminer M30 and M31 series, and Antminer S19 series, will be shipped out and turned on. If the bull market lasts, new ASIC models may be rolled out at a faster pace. Additionally, as pandemic pressures ease and the capacity for chip production increases, the hashrate market is likely to grow faster than it did in 2020.

In any case, there will be a delay before machines are delivered to farms and switched on. Many ASICs are estimated to be delivered in the second half of 2021. Because of this, we can expect that 16nm ASICs such as the S9 will still be running profitably at current price and hashrate levels, and they will survive for even longer if prices favor rigs with high power consumption.

We will probably see a trend toward hashrate being more widely distributed geographically, since many old-gen machines have been moved to regions that can provide lower electricity costs than the Chinese wet season region. There has also been news coming out about orders for new rigs being placed by miners from North America, Russia, and Kazakhstan, as well as parts of South America.

With the market so bullish, more miners in more parts of the world can take part in the competition. Could Bitcoin mining become more decentralized in 2021 than ever before?

Let the mining continue!

In 2021, f2pool will continue to contribute to the crypto community by securing the Proof of Work world and generating value with and for our miners.

Thank you for choosing f2pool. Here’s to a decentralized 2021!

To stay updated with the latest Proof of Work news and developments, follow us on Twitter.