We’re seeing the mining and finance worlds coming closer together, with large operators offering financial services tied to their mining activities. Bitcoin miners, just like traditional commodity miners, will likely become large users of derivatives.

Bitcoin mining has grown into a multibillion-dollar industry. Mining pools, hardware manufacturers and large farms are all contributing to the growth and professionalization of the space. Financial service companies are bringing institutional capital and financial products to increase liquidity for the biggest players.

This piece follows the Crypto Tonight discussion about decentralization, finance and security between some of the founders and CEOs from within the mining industry and leaders from some of the most relevant financial service operators. We will explore whether the introduction of debt and derivatives is likely to be a help or a hindrance to the security and success of Bitcoin.

Chun, the co-founder of f2pool, explained that they are a mining pool and don’t actually own that much hashrate themselves. Compared to miners, the halving will have limited impact on the operations of a mining pool.

f2pool mined the first 12.5 BTC block in 2016, and as we approach the third bitcoin halving, Chun was quite concerned by the 12 March 2020 price crash. The price of bitcoin went as low as $3,800 and if the price had continued at that level then a lot of miners would be forced to shut off their mining equipment.

The $3800 crash prior to the 3rd Bitcoin halving concerned me. If the price kept at that level, many miners would be forced to shut off their equipment, leading to longer transaction times.

Chun Wang, Co-Founder at f2pool

Miners switching off would lead to longer waiting times for executing transactions and the Bitcoin blockchain could slow down for a period of time post-halving, as happened with the Bitcoin Cash and Bitcoin SV networks. Thankfully the price returned to around $7,200, three weeks before the 2020 halving.

Another concern, shared by Chun, is that the security of the network is linked directly to the mining rewards. With each halving, the mining reward becomes lower in comparison to the transaction fees, and the network may become less secure.

Low block rewards open Bitcoin up to attacks connected to transaction fees. In 2013, there was a transaction with a 200 BTC fee. At the time, the block reward was 25 BTC and bitcoin had a value of around $100. That means the mistaken fees, which were eventually returned by ASICminer to the person making the transaction, were worth $20,000 and the block reward was worth only $2,500.

Fast forward to 2020 and that same 200 BTC mistake would cost around $15.4 million in transaction fees, and the block reward post-halving would only be 6.25 BTC (around $48,000 at a BTC price of $7,000). The difference in value for a single block with a mistakenly large amount of fees set could lead to pool operators having to make a decision about which block to mine.

A selfish pool may choose to ignore the 200+ BTC block mined by the other pool which mined it first, and try to mine the block for themselves. This could lead to a chain split as mining pools, or groups of pools, mine the second newest block instead. With 6.25 BTC rewards this is not a general threat to the system, but with progressive halvings and lower block rewards, the portion of transaction fees will become more influential. So even if this is not a risk factor right now, it could become a problem in the future.

Beyond the Halving

Beyond the unique risks presented by the halving, other pool operators are considering how to secure the protocol itself and how to work with finance experts to bring more liquidity to the industry.

Jan, the co-founder and co-CEO of Slush Pool explains that pool operators should do their best to strengthen Bitcoin. There are not too many initiatives out there that try to secure the mining protocol.

It’s an issue that nobody seems to really think about too much and maybe that’s because we haven’t had any major incidents or hashrate being hijacked. However, if this becomes a standard attack from bad players, it may end up being too late to do anything about it.

Jan Čapek, CEO and Co-Founder of Slush Pool

Aside from securing the protocol, Jan believes when you consider the size and maturity of the industry, and the amount of money that is flowing into securing the blockchain by building larger farms, large players need to take their financing options seriously.

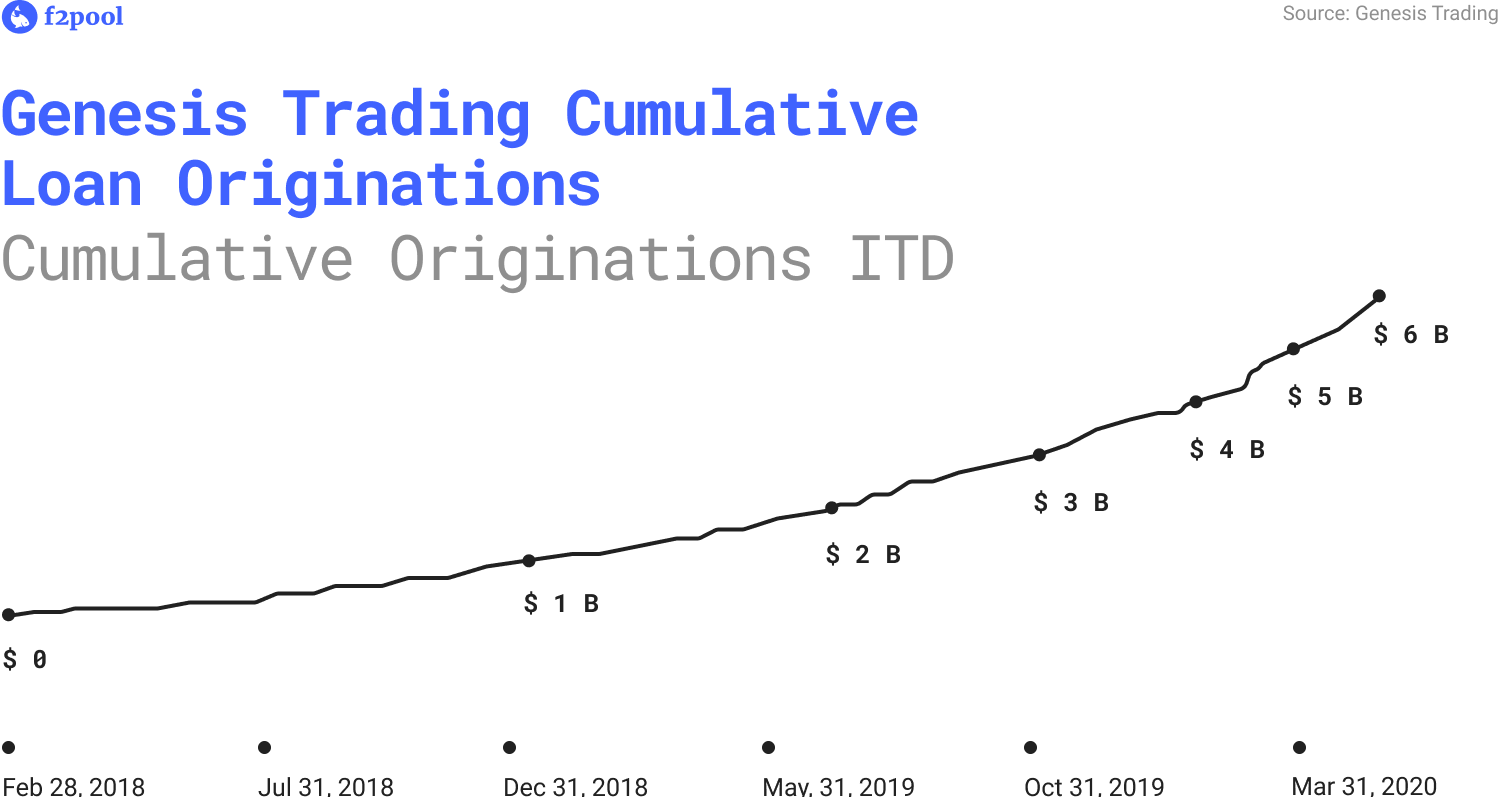

As Su Zhu, the CEO of Three Arrows Capital, notes, there has been a big trend of miners opting to borrow fiat to pay expenses without selling their coins.

If firms can get a better understanding of where their yields come from, who and why is borrowing and how people will pay for it, that will be a good step forward for this industry.

Su Zhu, CEO of Three Arrows Capital

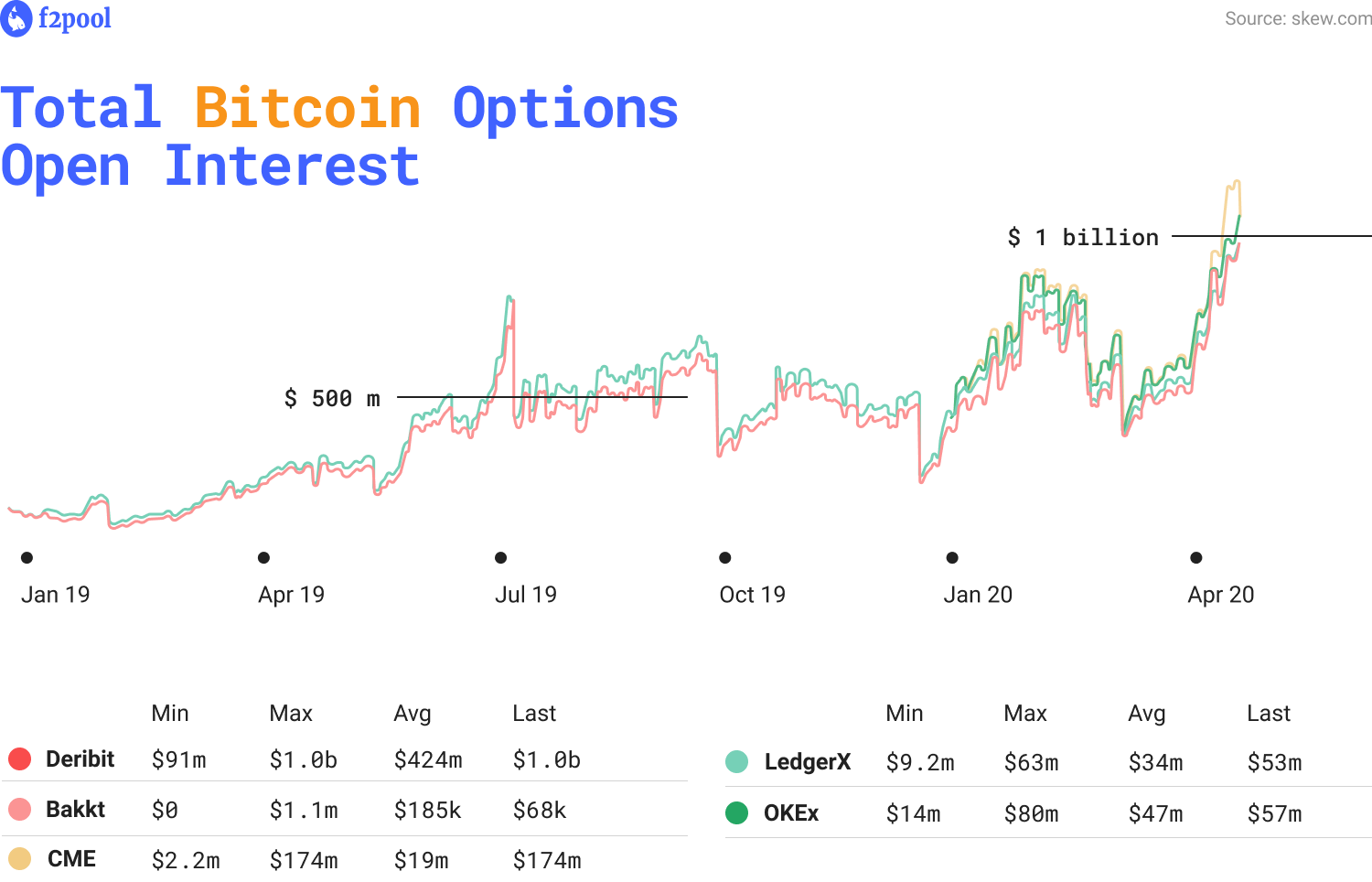

At their core, the bitcoin lending markets have been supported by the number of crypto derivatives becoming available, with BTC/USD swaps and futures, that people are able to trade with. These trades generate an implied interest rate on BTC, with which traders can borrow BTC against USD or vice versa.

We’re already seeing the mining and finance worlds coming closer together, with large mining pools and operators offering financial services tied to their mining activities. As a fund manager, Su Zhu is always trying to educate mining operators on how to protect themselves from financial risks. It’s quite important for the systemic health of the market that there’s not as much of a leverage build up as we saw in March 2020.

Derivatives and Spot Prices Converge

Six or seven years ago, on sites like BTCjam, people were simply lending money and hoping that they would get paid back. Fast-forward to today; people are now able to do things like looking for different LTVs as an arbitrage against the underlying market.

For firms doing the arbitrage trade, there should be a pledge for quality especially considering the price crash in March 2020. There was a concept of false diversification, where the thoughts were: lending to many different firms doing the same thing is safer than lending to a few larger firms.

Now people have stepped back and said okay, what do we actually know about these firms that are conducting these activities, and what funds do we think they would have available to meet a margin call. At the end of the day it’s about how these firms are thinking about risk and black swan events.

When the market crash occurred, Su Zhu saw firms sit back, even though it was very profitable then to lend BTC into the market and when the market became safe again they wanted to lend again, even though the LTV became more aggressive and terms got tighter. When the curve was very steep there was a lot of interest in borrowing USD against BTC and then after the March crash there was a lot of interest to borrow BTC against USD.

Su Zhu hopes that excess USD in the crypto system will flow more quickly to smoothen out the markets and to not allow these big bounties to be built up on the way down. This impacts the miners who are borrowing for other reasons. If miners are borrowing fiat against coins to pay for expenses, while leverage traders are also borrowing dollars to buy more bitcoin with their bitcoin, there can be a crowding out effect. This kind of behaviour is healthy for the market because it ties together the demand in the spot market with the demand in derivatives.

Counterparty Risk

Leon Marshall highlights that the explosion of derivative markets and basis trading has been a key part of the recent growth in bitcoin lending. Miners and institutions make up a fair amount of the dollar borrowing demand at his firm Genesis Capital.

One thing that was clear in the recent move lower was that many counterparties, particularly in China, were completely wiped out through liquidations. One thing Genesis focuses on is building longer term relationships with mining pools and operators so that they are not at risk of being liquidated at the drop of a hat. Every party needs to protect themselves but the most professional financial service providers will aim to ensure that the client still exists after the charts move lower.

Leon Marshal, Head of Business Development at Genesis Trading

In reference to the March 12 crash, Genesis had done a fair amount of scenario analysis and stress testing for how they would protect themselves if crypto prices fell by 50%. Some of the thinking around that analysis led them to become more proactive, ensuring that they had sufficient collateral to meet their own margin calls.

What miners and mining pools seem to care about the most are interest rates and collateral requirements. One area of distinction is to also find a trusted and reliable counterparty. The regulatory requirements and stringent collateral requirements for licenced financial services are a consequence of the fact that those firms deal with capital of other parties when sending loans to miners and mining pools.

Some financial services providers protect themselves by only providing lending to the best clients and highly rated counterparts. The top firms understand the wishes for low rates and low collateral and try to balance that with the need to reduce risk for all parties.

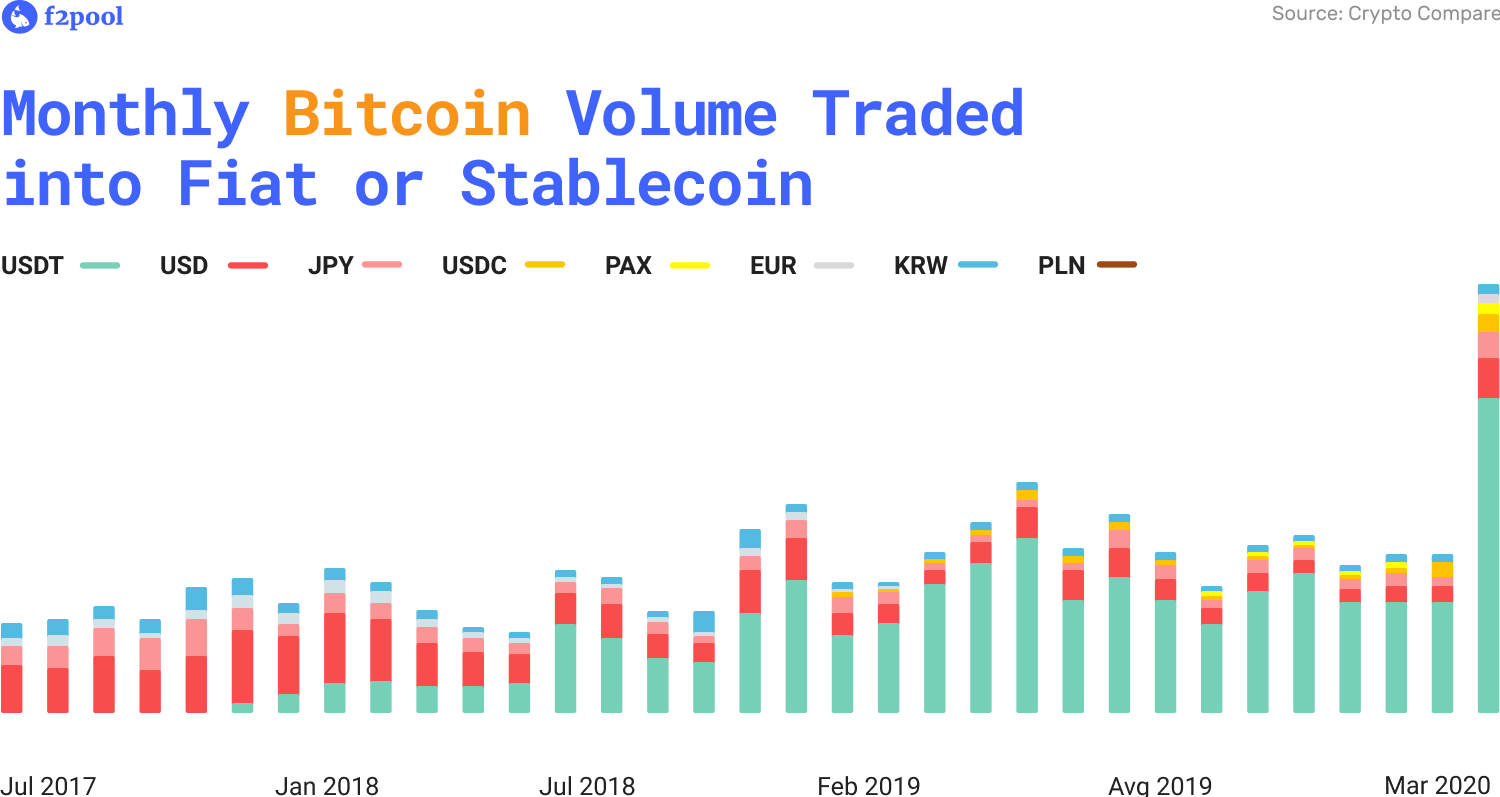

The Impact of Tether

Another financial risk factor is the over dependence on USDT Tether for liquidity. Wu Gang, founder and CEO of Bixin, comments that the recent growth in the market cap of stable coins is an indication in the increasing demand for liquidity for crypto assets. The demand for USDT trading is particularly strong in Asia where it makes up 70% of bitcoin trades. The collapse of Tether would lead to a crash in crypto markets.

Yama Zhang from Crypto Tonight reports that

There is a big community of USDT users in Asia, but the people who have been in the space for a longer time are actually quite concerned about Tether. It is worrying and there is a feeling in the established Bitcoin community that it is a real threat. This is why companies like Bixin developed their BTC stable coin.

Yama Zhang, Host of Crypto Tonight

This is where Bixin’s idea for a bitcoin-backed stable coin comes from; to increase liquidity and reduce the risk created by Tether’s dominance. USDS, their bitcoin-backed coin, has been available in the Bixin wallet for the past month. Traders are already familiar with these kinds of assets and therefore they are ideal for crypto loans than can provide a stable interest rate.

For Zac Prince, founder and CEO of BlockFi, the two things he considers really important are Communication and Education. There are things that finance companies and miners can learn from each other to help them improve their businesses and smoothly transact with each other. Getting leaders to talk to each other and share discoveries publicly is very helpful.

On the education side, he states that in order to raise the price of BTC we’re going to require more adoption. It will help to mitigate some of the risks explored in this article. Working together to make crypto easier to use, to educate people on why they should be buying these assets; and to continue to be good actors in the space we will build more trust for the entire industry.

BlockFi has thought a lot about security and there’s a number of different things that they have done to create a trusted and a safe environment. They decided early on that what they are not looking to build for the market is a custody solution. So they partnered with Gemini, for the safe custody of all crypto assets held via BlockFi.

Gemini has a sophisticated cold storage setup, as well as their own insurance company to protect from cyber theft and operational issues. They were also the first company to go through SOC level two audits; which is a heavy duty audit that not only looks at cybersecurity but also operational controls.

In addition to their three years track record with no lending losses or security losses, BlockFi is heavily regulated in the US market for money transmission and lending, which leads to a great deal of oversight and ongoing checks. Beyond that, an important factor for BlockFi’s institutional counterparties, is the financial health of their own company, and they have recently raised additional capital and provide audited monthly and annual financials.

Bitcoin miners will use derivatives like traditional miners

Bitcoin miners, just like traditional commodity miners, will likely become large users of derivatives; whether it’s with futures to lock in prices or options to hedge. There is a fundamental shortage of dollars available in this space, relative to the overall demand in certain market conditions; which is one of the contributing factors to volatility in the markets.

Raising more institutional capital and educating scalable sources of low-cost capital about this industry will lead to more opportunities for funding. Expanding access to capital is going to be tremendously important. Everything is going to get more sophisticated and you don’t have to look very far to find good analogies for what we’d expect to happen to this space over time.

Everybody with a business that has a relatively predictable cash flow is going to have an appetite for access to debt capital in order to reduce the capital requirements necessary to fund their growth.

When you look at the macro backdrop with yields in the US going negative for the first time, Zac thinks there will be an increasing willingness to look at other asset classes in order to achieve positive yields. When, as we saw in March 2020, arbitrage rates are implying 40% annualized returns, then regardless of their perspective on this asset class people are starting to pay attention.

The other factor which will affect liquidity is that banks around the world, and in Europe in particular, are starting to become comfortable about using bitcoin as collateral. Zac thinks that when this trend continues and we see more of that happening we will begin to see new sources of capital entering the industry and will have a profound impact on lending rates.

Jan, co-founder and co-CEO of Slush Pool, agrees that the current trend is for mining operations to scale up and become more professional. He believes there is definitely a need for hashrate derivatives and transaction fee derivatives. Miners need these products in order to hedge against the risk of increasing difficulty.

If there is no long term viability for the mining industry, we won’t have Bitcoin.

Jan Čapek, CEO and Co-Founder of Slush Pool

For mining pool operators without a deep financial background, it’s unclear for them how the risk of these new assets should be calculated, or who would be willing to take those risks. Leaders from the finance industry working with leaders from the mining industry will lead to these details being addressed.