A year with a Bitcoin halving and global epidemic rolled into one, it's truly one of a kind. Let’s review the first six months with the Top 10 most impactful moments.

We’re halfway through 2020, and the mining industry has already faced several enormous challenges. Miners had to battle off the macroeconomic black swan of March, pass through the smoke of the halving and a pandemic, and now they’re gearing up for the rest of the year’s competitive battlefield.

A year with a Bitcoin halving and global epidemic rolled into one, it’s truly one of a kind. Let’s review the first six months with the Top 10 most impactful moments.

1. Global Black Swan hits miners

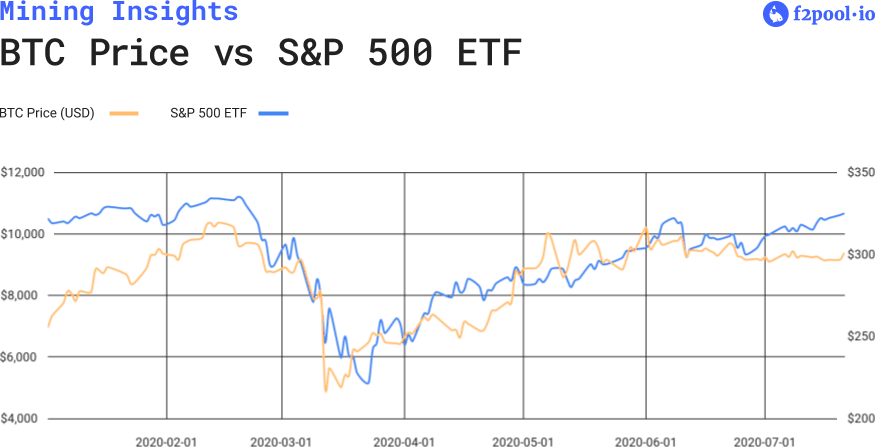

Black Thursday was the first blow for the miners in 2020. On March 12, Bitcoin plunged by more than 50% to $3,800. Before that, Bitcoin had already fallen from $10,000 to $8,000, and the market still hadn’t had time to digest it.

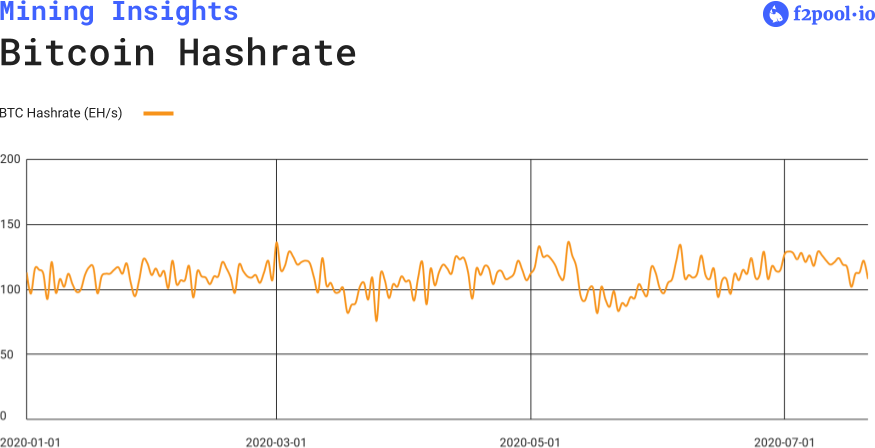

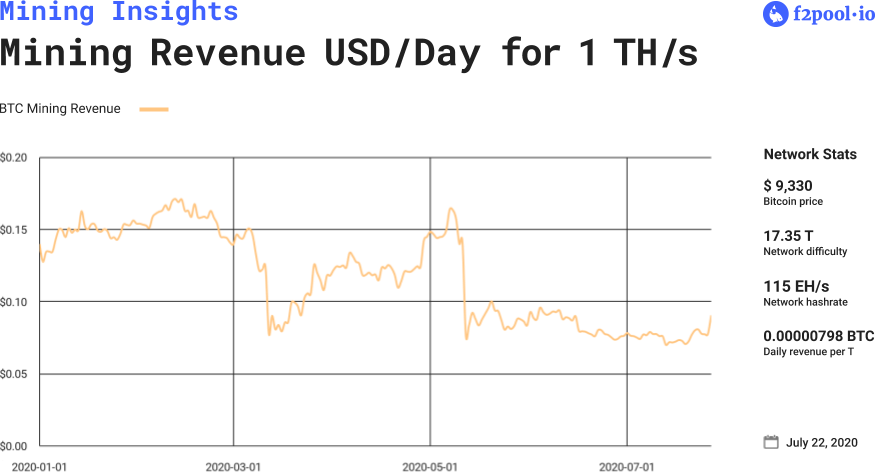

The price drop caused many ASIC machine models to reach their operational break-even price, and the Bitcoin network hashrate dropped from about 124 EH/s to 95 EH/s, a drop of 23%.

The significant drop was partly related to speculation and leverage used by investors earlier in the year. However, the macro impact of the global pandemic on traditional capital markets cannot be overlooked. In March, the trading of US stocks hit with the circuit breaker four times in 10 days (Mar. 9, 12, 16, and 18). And so after in April, negative oil prices created history.

Black Thursday reminded miners that the severity of the pandemic was strong enough to affect the cryptocurrency market, and showed that society’s demand for survival is more significant than holding a safe haven asset.

2. Halving’s Galore

Mined coins are scarcer than ever. In the first half of 2020 and before the Bitcoin halving, six other prominent proof-of-work coins also halved or had a significant block reduction, including BEAM (January 5), ETC (March 17), BCH (April 8), BSV (April 9), SERO (April 14), and DASH (April 28).

With massive anticipation for each halving, there was an increased expectation for coin price appreciation. However, price increases post-halving were almost non-existent and were no match for the steady price increases we had seen from the beginning of 2019 until the halvings themselves. It’s becoming clear that in 2020, price action for coin halvings is already priced into markets before the events have even taken place.

Following each halving, the hashrate of many of these coins dropped as machines turned off, stabilized, and started to increase again.

3. Bitcoin completes its third halving

On May 11, 2020, Bitcoin’s last 12.5 BTC block and the first 6.25 BTC block were mined within the space of 20 seconds. The next block followed 40 minutes later, and for the first 24 hours after the 6.25 epoch began, only 137 blocks were mined, suggesting that miners were still somewhat unprepared for the new era.

The halving also introduced a short-term arbitrage opportunity. Savvy miners switched their SHA256 hashrate to mine BCH and BSV and managed to increase their mining revenue per TH/s. This arbitrage spread quickly leveled within a few hours.

The halving effect was not as immediate as expected, as the Bitcoin price did not see any significant fluctuations and even fell slightly.

On the day of the halving, the hashrate of the top 10 mining pools dropped by about 18 EH/s, taking the network hashrate from around 120 EH/s to around 100 EH/s. Many miners chose to temporarily shut down their machines and wait for the next difficulty adjustment and the start of the Sichuan Hydro Season to start mining again.

For the Bitcoin community in both the East and West, the halving was also a moment to celebrate the meaning of Bitcoin and why we are all here:

f2pool celebrated the final block of the 12.5 epoch by recording The New York Times headline: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.” into the block, paying tribute to the message of Satoshi Nakomoto in the Genesis Block. This time, miners were not only mining but also writing history together.

4. Miners complete the “Great Migration” to prepare for the Sichuan hydro season

The annual Hydro Season arrived right after the halving. This year’s Hydro Season began at the end of May, and with the Great Migration, it took machines 1-2 weeks to arrive in Sichuan from Xinjiang in the north-west.

Some mining machines never made it out of Sichuan to Xinjiang at the end of the 2019 Hydro Season, meaning they were sitting around waiting to be turned on straight away. Other old-gen machines remained in Xinjiang and were not rushed to Sichuan, as those mining operators decided to wait to see if the reduced mining revenue from the halving would be enough to cover the costs to run the machines.

The Hydro Season average price of less than 0.23 RMB (approx. $0.033) for hosting means mining costs are greatly reduced. The continuous supply of machines with 50 W/T or better, the reduced difficulty after the halving, and the extremely competitive Hydro Season prices have led the Bitcoin network hashrate pushing to an all-time high again.

The beginning of the Hydro Season also coincided with the relaxation of domestic travel restrictions caused by COVID19. Mining operators were able to meet offline in the powerhouse city of mining, Chengdu, to discuss new business opportunities. However, delays in the ASIC miner supply chain caused by the epidemic and challenges within the global economy affected hardware production capacity, resulting in limited large-scale deployment of new mining machines at the beginning of the Hydro Season.

5. Large farms struggle to fulfill hosting capacity

The Hydro Season started earlier in 2020 compared to last year, and with around 30% of the older machine models of the network no longer profitable, some power resources became unused. This situation has also led to an increased difficulty for farms to attract investment into some mines, and the hosting business has changed from a “seller’s market” to a “buyer’s market.” At the same time, some mines have opted for profit-sharing models with clients to attract business and share risks and profits.

Mining farms in Sichuan have faced an unprecedented investment challenge. In the eyes of many old Chinese miners, the electricity price right now is not only lower than the similar situation of the halving + Hydro Season four years ago but also even lower than the electricity prices during the 2015 bear market.

Today, more than 87% of bitcoin has already been mined, and the profit margin of mining is even thinner. Miners need to minimize costs further and focus on the long-term stability and operational capability of the mining farm.

6. A new generation of popular mining machines

Although new ASIC machines with higher hashrate and improved power consumption are introduced to the market every year, there are still significant changes in 2020. A new generation of miners has brought the end of the hardware competition of the previous epoch and signified the beginning of a new round of the “arms race”.

As up to 30% of old-gen machines may be eliminated, the most-used models will transition from 60-80 W/T to 40-60 W/T machines. With the launch of the M30 and S19 series, flagship model replacement has already begun.

During the Hydro Season, 85 W/T mining machines have been turning on and off according to the rise and fall of the Bitcoin price. After the Hydro Season finishes this year, the mining revenue at the electricity cost of 0.35 RMB ($0.05) will no longer be able to offset the electricity costs if the Bitcoin price does not have a sharp increase. This could be the beginning of the end for the S9’s with their extensive mining history.

7. The rise of altcoin mining

Some lesser-known coins surprised the market and gained recognition and support from the community and miners. GRIN, BEAM, CKB, and HNS and other promising projects with strong technical fundamentals continued to grow and increase in popularity.

In the first half of the year, CKB and HNS ASIC mining machines were launched, and vast amounts of capital poured in to support the R&D efforts of ASIC manufacturing. As of right now, the yearly proof-of-work output is around $15 million and $8 million, respectively.

f2pool Labs launched KDA, HNS, TRB, RVC, UFO, and other new coins in the first half of the year, providing miners with a greater selection of coins to profit from.

Early attention and support from mining pools, mining machine manufacturers, and exchanges underpin the ecosystems of these new projects, and some of these coins are sure to keep growing and become mainstream in the eyes of the wider industry.

8. Mining finance and derivatives garner more attention

The diversification of financial products for mining began in the first half of 2020. The block halving and new cycle of hardware replacement caused miners to pay more attention to traditional financial instruments.

Along with the usual demand to pay for electricity bills, large-scale new-gen machine purchases and hardware relocation during the first half of the year made miner’s loan demand stronger. The March 12 Black Thursday event reminded miners of the importance of hedging price risk, and companies such as Cobo, Genesis Capital, and others developed hedging products for miners. Miners began to use these financial products to minimize risk.

Hashrate financial derivatives were also launched. CoinMetrics launched a hashrate indicator, FTX launched hashrate futures, and other companies have been building and exploring hashrate products to lead the mining industry into hashrate financialization.

9. 60% of Ethereum GPU cards will be replaced

Ethereum mining revenue has been relatively stable, and it is not as sensitive to electricity prices. During the first half of 2020, many Ethereum miners needed to upgrade or replace their mining hardware.

The DAG file of Ethereum will reach 4 GB by December 2020. At this point, 4GB GPU cards, which account for about 60% of the network hashrate, will not be able to continue ETH mining.

4 GB GPU card manufacturers have improved their firmware to extend the life of the mining rigs for several months. Some GPU card models adopt BIOS upgrades to expand capacity. At the same time, some large mining companies have already started large-scale hardware replacement.

Although Ethereum will continue as a proof-of-work blockchain for the near future, there is an increasing amount of effort to move Ethereum to proof-of-stake. The GPU mining community is looking to find other GPU-mined coins that can become the next ETH.

10. NASDAQ IPO for ASIC manufacturers

In June, Ebang succeeded with their IPO, not too long after Canaan went public on NASDAQ in November last year.

After two unsuccessful attempts to list on the Hong Kong Stock Exchange, Ebang made history to be only the second mining manufacturer to complete their IPO.

The COVID19 pandemic has severely hit the global capital market, and ASIC manufacturers have not stopped seeking mainstream financing. Although they are currently “cold” in the capital market, these companies are looking for other ways to grow their business.

Looking ahead to the second half of 2020

These 10 events were pivotal in shaping the Bitcoin mining to start the decade and affected the structure and layout of the industry on many levels. It was the prelude for this year’s “second half battle”. Let’s take a look at how some of these trends might play out in the second half of the year.

Filecoin mainnet launch

As one of the most highly anticipated proof-of-work network launches, the Filecoin mainnet launch is almost here. If everything goes to plan, Filecoin will announce detailed information about the Filecoin mining by the end of July and plans to launch the mainnet by the end of August.

In 2017, the Filecoin whitepaper was published, and the project completed the largest initial fundraising at the time, raising a total of 275 million USD. There is huge anticipation to see how Filecoin will perform after the mainnet launch.

Moving to Ethereum 2.0

Ethereum’s transition from its proof-of-work consensus algorithm to proof-of-stake has been a long time coming. According to Ethereum core developers, if everything goes smoothly, the Ethereum 2.0 mainnet will go live at the end of 2020 or during 2021.

Phase 0 will lead the way toward realizing this new, more scalable network. After Phase 0, there will be several phases before we reach the full Ethereum 2.0 implementation. Since Ethereum 1.0 and 2.0 are two independent blockchains, the transition process will be carried out gradually, and miners will still be able to continue proof-of-work mining for the following few years.

There are currently more than 800 verification nodes participating in the Ethereum 2.0 testnet, which demonstrates considerable support from the developer community, and the promises of its new monetary policy and high scalability network are causing huge anticipation for the transition.

Halving season continues

The Bitcoin halving has already completed, but several other prominent proof-of-work coins will experience a halving soon. There are eight coins that f2pool supports and will have a halving in the second half of the year.

Starting in July, there will be a halving every month. BCD and PASC (July), ZEL and MONA (August), XZC (September), CLO (October), ZEC (November), and lastly, ZEN (December).

Bitcoin haskrate distribution

The Sichuan Hydro Season will continue until the end of October, and another Great Migration will begin. There will be no more ultra-low Hydro Season electricity prices and those mining machines with poor efficiency will likely be switched off.

Large mining farms have recently been built, or currently being set up in North America, with a large number of companies setting up in Texas, including Crusoe Energy, Layer1, Northern Data and Immersion Systems. Core Scientific, Riot Blockchain, and others have already made large purchase orders of new-gen machines. There are also farms being set up in other corners of the globe looking to capitalize on cheap power.

It’s going to be fascinating to watch the change in geographical hashrate distribution over the coming months.

Looking toward the next BTC bull market

Notwithstanding the anticipation of the Ethereum 2.0 and upcoming Filecoin mainnet launch, and the recent rise of DeFi and new ASICs for altcoin mining, Bitcoin still remains the kingpin of the industry.

Now that we are at the beginning of the 6.25 block reward epoch, the path is clear for any Bitcoin miner. Optimize your operation, minimize your risks and costs, explore new business opportunities, and prepare yourself for the next bullish cycle in the post-halving era.