The inertia that keeps the majority of hashrate in China could eventually lose its grip on the mining industry. How centralized is mining today, and what factors are encouraging adoption in the rest of the world?

Apart from the fixed supply, the beauty of Satoshi Nakamoto’s invention is the fact that he unleashed onto the world something that is truly decentralized. There is no central point of failure. Authorities cannot simply detain the founders, seize a centralized server with all the transaction records, nor block one person sending some bitcoin to someone else.

I like to think of Bitcoin as a many-headed hydra.

Hercules was no match for the Hydra, who was so clever that she sent forth many heads in place of each one that was cut off.

Platoin Euthydemus, 297c

According to the myth, Hercules was not able to defeat the Hydra on his own because every time he would cut off one of its heads, a new one would grow in its place. This is true for Bitcoin mining.

When one farm closes, another opens.

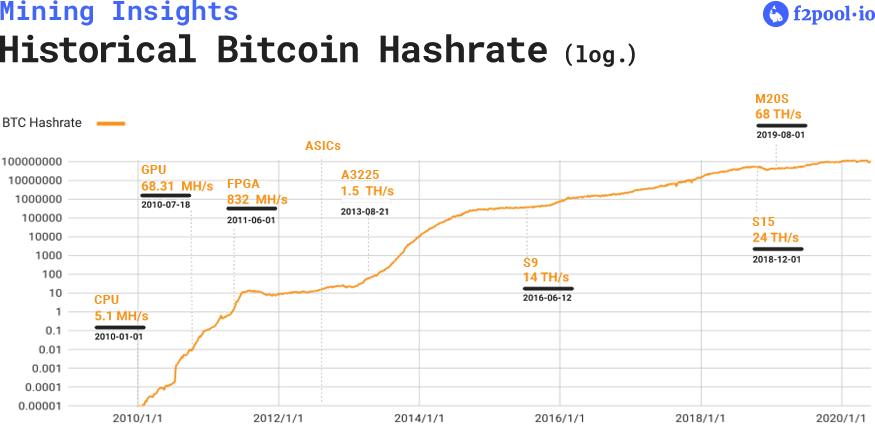

This has contributed to the continual acceleration in the amount of computing power supporting and securing the Bitcoin network; despite notable bankruptcies and closures of certain manufacturers and industrial scale mining farms as well as the disappearance of mining pools that used to dominate global hashrate.

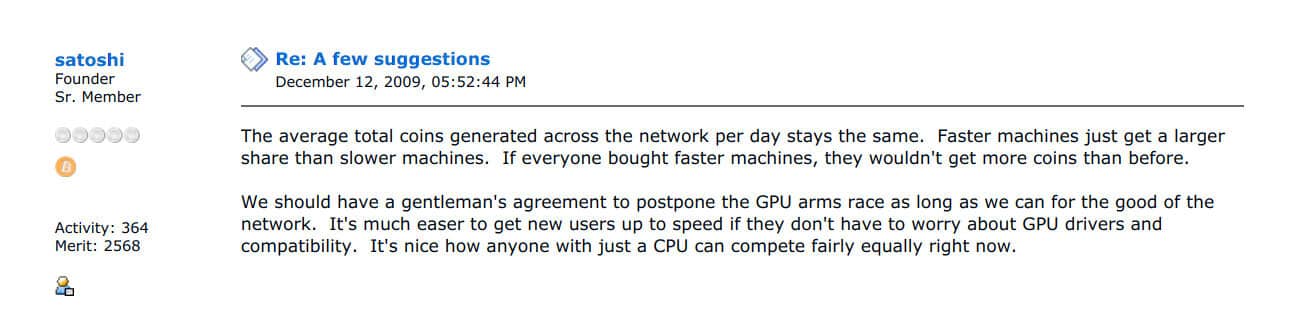

The introduction of GPU mining in 2010 pushed global hashrate past 1 billion hashes per second (1 GH/s). That’s still 100,000,000,000 times smaller than the 100 EH/s that currently mine Bitcoin. As early as December 2009, Satoshi was calling for a “gentleman’s agreement to postpone the GPU arms race”. His argument was pretty clear: the higher the barrier to entry for miners, the harder it will be for new users to mine Bitcoin.

Fast forward 10 years, and unsurprisingly Satoshi was right. You now need highly specialized ASICs, and the humble GPU has been incapable of mining Bitcoin profitably since spring 2013. The barriers to entry are real, anybody who wants to profit from mining needs access to modern, efficient machines, low-cost electricity and a political situation where mining is either completely legal, or as it is for many countries, where there is no clear legislation making it impossible to mine.

How well is Bitcoin mining distributed around the world?

It’s true to say that Bitcoin mining is quite well distributed around the world. Research from CoinShares, however, shows a tendency for mining operations to cluster in places with geographic and economic similarities.

Mining is predominantly confined to technologically advanced, sparsely populated and mountainous regions that have powerful rivers running through them. Places like New York State and Quebec in North America, Siberia, northern Scandinavia and of course Sichuan province in China.

Some of the exceptions to this are places like Kazakhstan, Iran and Xinjiang as well as places where mining is smaller but growing like Texas. Miners are also operating in Venezuela, where hardware is almost impossible to import and carries a 3-4x price premium.

Companies based in China have led the charge for securing the Bitcoin network. So far, it is Chinese manufacturers that have consistently created the most efficient Bitcoin mining hardware and it has resulted in Chinese miners adding the largest amount of hashrate.

Ethan Vera, Luxor Co-Founder

Why: to leverage local infrastructure and scale rapidly

Bitcoin mining is a margins game. As the global hashrate steadily increases, mining operators need to reduce their capital and operating expenses. Mining in China cuts delivery times, removes export duties and greatly reduces logistics costs.

Until the release of the S9 in 2016, hardware replacement cycles were as short as one to six months. Miners had to get their machines running as quickly as possible in order to create positive returns on their hardware investments. This created a lot of momentum for mining in China because ASIC hardware is manufactured there.

Many hardware manufacturers have their offices in Beijing and the products are typically manufactured in Shenzhen. It means that when speed was the most important thing, mining exclusively in China made a lot of sense. As hardware replacement cycles continue to increase we can expect that other dynamics will come into play, leading to more miners diversifying outside of China.

Why: The Hydro Season

Every year, usually between May and October, the Chinese Hydro Season offers mining operators extremely low electricity prices. This is due to the surplus capacity of the hydroelectric power stations in the region.

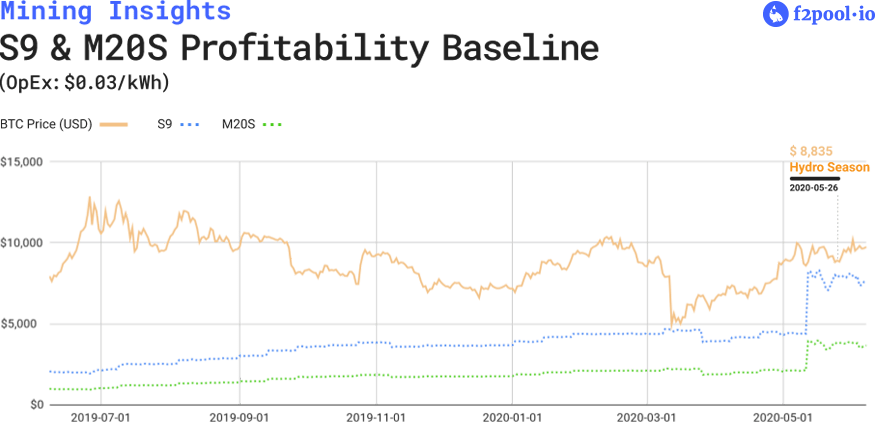

At the start of the 2020 Hydro Season, even S9s which are now 3-4 years into their lifecycle remain profitable for individuals and institutions that have access to all-in electricity costs of around $0.03 kWh.

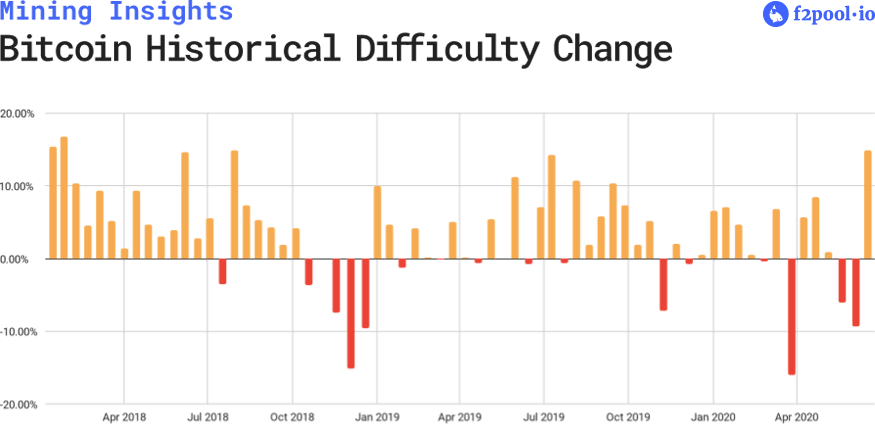

The Black Thursday crash of March 12 occurred prior to the Hydro Season, and at that time when operating expenses in China were higher there was a distinct drop in hashrate for the pools that mostly facilitate Chinese mining. Exchange pools like Huobi and OKex, that have almost exclusively Chinese customers, saw the largest drops.

This indicates that a large proportion of the hashrate for these miners was in fact old-gen S9s. The start of the 2020 Hydro Season has seen a dramatic rise in global hashrate, once again indicating that operators in China have been able to switch their S9s back on. It makes sense that the owners of the hardware kept the machines in China so that they could benefit from the expected last six months of profitability of that generation of machines.

The risk of too much hashrate being in China

Centralization is a threat to the Bitcoin network. One of the reasons Bitcoin survived through its early years is because it went relatively unnoticed. It would have been a lot easier for the authorities to shut Bitcoin down during its infancy, simply for the fact that there were fewer hydra heads ready to grow back if any of the earliest miners had been forced offline.

Over the years, Bitcoin has become exponentially more decentralized: geographically, economically and technologically. We now count hashrate in its quintillions and this is a good thing for Bitcoiners all around the world.

The people who launched Bitcoin companies in Asia, such as pools or manufacturers, are Bitcoiners. They’re no different to Bitcoiners in Europe, North America or elsewhere.

Thomas Heller, f2pool Global Business Director

The risk to Bitcoin’s overloading of hashrate in China is less about the Bitcoiners themselves and more about the threat of a single power shutting off and perhaps confiscating the hardware. In practical terms this would need to be an extremely well coordinated attack, because even within China the active hardware is distributed across multiple regions with differing power structures and incentives.

It’s also unlikely that China would want to end mining, when it is actively seeking foreign investment to multiple sectors and at the local level industrialists need buyers for their excess energy. If there was a sudden crackdown on mining that included hardware seizures then international investors will quickly look to deploy their hardware elsewhere. The network itself is entirely censorship resistant, anybody can join and anybody can leave.

As Ethan Vera theorized in a Hashr8 podcast earlier in 2020: other than hardware seizure, a secondary attack vector could be directed at the pools themselves. If a central authority brought in senior individuals from the pools they could, theoretically, control a large enough percentage of hashrate to launch a 51% attack. If successful this would cause a lot of damage to the reputation of Bitcoin’s security and prices would likely plummet. However, once again, the very nature of Bitcoin’s true decentralization makes this attack unlikely.

Individual miners are not tied to any one pool. If this kind of attack was underway it is likely that the metaphorical immune system of Bitcoin would kick in, and people would quickly point their hashrate elsewhere.

Also, on a practical level, pools like f2pool are decentralized when it comes to the geographical location of their servers, their employees and even their offices. f2pool’s ambition is to be nationless, in the same way that Satoshi Nakamoto, and Bitcoin itself, are not tied to any nation state.

Why would miners leave China?

The inertia that keeps the majority of hashrate in China could eventually lose its grip on the mining industry. It is likely that the development of farms outside of China will increase its pace in 2020 and beyond.

Operators may look to leave China for the following reasons:

- Regulatory Uncertainty Moving to locations where there is clarity on the regulatory framework for mining

- Investor Demand Traditional investors who are looking to gain exposure to mining may expect certain geo-locations

- Competitive Energy Pricing Some locations outperform China in both the dry and hydro seasons in terms of energy price.

The Future of Bitcoin Mining

Bitcoin mining is growing up. We have seen the industry achieve new levels of professionalisation and financialization. ASIC life cycles are getting longer and longer, and this means that mining operators can expect predictable cash flow, even with the continuing volatility of the underlying asset.

Bitcoin derivatives and access to capital are opening the doors for large scale mining operations all around the world. Greater predictability will lead to more mature players and many of those players will look to operate outside of China.

In the future centralization concerns are likely to be more focused on the scale of individual operations, rather than where they are geographically located. We expect innovation and direct to consumer mining opportunities to level the playing field over time.