Yes, you can! In fact, profits can be huge if various underlying economic variables are taken into account. At the same time, Bitcoin mining can be a loss-making activity if you have an inadequate understanding of the economics.

In this article, we’ll go beneath the surface in understanding the potential monetary gains from Bitcoin mining. Let’s examine the biggest factors that play a role in determining profits:

1. Electricity price

2. Mining hardware

3. Location

4. Selection of a mining pool

5. Network statistics

6. Market sentiment

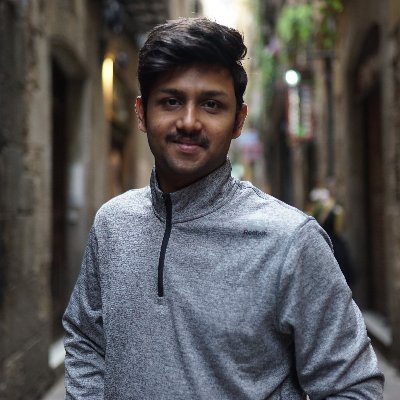

Bitcoin miners are incentivized by the block reward and by transaction fees. The current block reward for mining a block is 6.25 BTC, reduced by half from 12.5 BTC on May 11, 2020. The second component of the incentive is transaction fees.

In this graph, we can observe the quarterly average of transaction fees in BTC awarded to miners. Looking at the timeline from Q4 2018 to Q2 2020, we see a gradual upward trend. One plausible explanation for transaction fees generally rising is that they become more important as an incentive as the block reward, which is halved every four years, decreases.

Electricity price

The price of electricity is one of the most important factors in achieving profits or breaking even with Bitcoin mining. As an integral part of operational expenses, it is advantageous for miners to negotiate a competitive deal with energy providers, if possible.

Many oil and gas companies create excess energy that would otherwise be wasted, and mining operators are beginning to take advantage of it, especially for Bitcoin mining. Upstream Data, a Canadian company that provides mobile mining hardware for rental and for sale, is supporting many companies in using this excess energy to bring in approximately 15 times the revenue of the market price of the fuel.

Miners in Sichuan in China and Siberia in Russia use cheap hydroelectric power from local energy companies during the hydro season. The advantages of sourcing cheap energy enables even miners with old-generation ASICs to reap profits.

Mining hardware

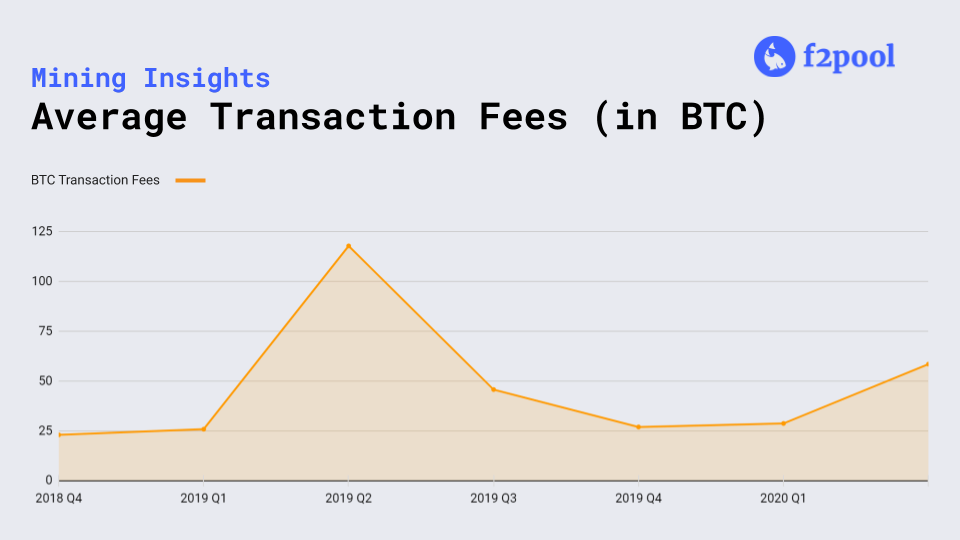

Application-specific integrated circuits (ASICs) are used to perform specific tasks. Mining hardware intended for mining Bitcoin must support the SHA256 algorithm. Mining hardware has evolved over time to support Bitcoin mining difficulty increases.

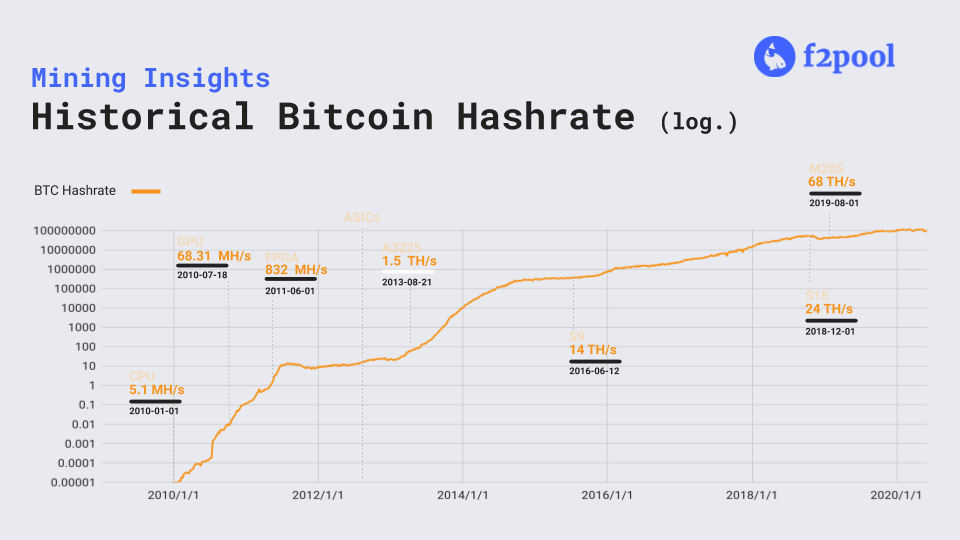

Factors such as hashrate and power consumption define the efficiency of ASICs. For example, consider an Antminer S9 with a hashrate of 13 TH/s and power consumption of 1300 W.

The efficiency of this machine can be calculated as follows:

power consumption (in watts) / hashrate (in TH) = 1300/13 = 100 W/T

The graph below shows an investment analysis for an Antminer S9 purchased on June 12, 2016 (the release date of the AntMiner S9) at a price of $1,674.

The fixed cost of the Antminer S9 is recovered in the first 156 days after purchase, i.e, on November 13, 2016.

To give an overall investment analysis scenario, let’s take a look at returns from the S&P 500 ETF compared to returns from BTC:

BTC

Amount of BTC that could have been purchased on June 12, 2016 with $1,674: 2.49704511

Amount of BTC that could have been purchased on March 16, 2020 (if the daily BTC earned was converted to fiat on the same day): 2.05

Amount of BTC that could have been hodled from June 12, 2016 to March 16, 2020: 6.292591

S&P 500 ETF

Maturity amount from S&P 500 ETF if $1,674 is invested on June 12, 2016 and withdrawn on March 16, 2020: $2,491.46

US Treasury bonds

Approximate maturity amount from 3-year and 5-year US Treasury bonds (purchased on June 12, 2016 and sold on March 16, 2020): $1,728.24

These numbers show the drastic differences between investment strategies. For these dates, mining and hodling BTC provides nearly 250% better returns than other strategies.

This analysis clearly shows that mining and hodling BTC can be an excellent option in terms of return on investment.

Location

Because ASICs work continuously to solve mathematical problems to mine and secure the Bitcoin network, the hardware tends to heat up. External cooling is required to maintain the temperature, and therefore the efficiency, of the hardware.

As the saying goes, “There’s no such thing as a free lunch,” and this is true for the cost of cooling. It’s not cheap, and it consumes a lot of energy that could be put to better use securing the network. This problem can be effectively nullified by using a naturally cool location.

Parts of Iceland, Norway, North America, Russia, and China are among the best examples of locations with optimal mining conditions.

Mining pool selection

Choosing a mining pool is one of the key decision-making factors in maximizing profits. While we know that solo miners take a long time to mine a block, a poor choice of mining pool comes with its own disadvantages.

The two key differences are: Payout scheme and Pool fees

There are several different kinds of payout schemes offered by mining pools, but the most common are PPS, PPLNS, FPPS, and PPS+.

PPS (Pay-Per-Share): Mining pools that use the PPS payout scheme eliminate risk for miners by providing a fixed income based on hashrate.

For example: Suppose a miner provides a hashrate of 1T, the hashrate of the whole mining pool is 100T, and the total hashrate on the network is 1000T. With the current block reward of 6.25 BTC and a pool hashrate of 10% of the network, the expected profit of the pool is approximately 0.625 BTC. Therefore, the expected pay for the miner is one hundredth of the expected pool profit, which comes to 0.00625 BTC.

Whether the pool successfully mines the block or not, the miner gets a share of the expected block reward. Transaction fees go to the pool.

PPLNS (Pay-Per-Last-N Shares): PPLNS is a method that considers a time window of N shares.

For example: Assume miners A, B, and C are providing hashrate for mining pool X. If X mines a block after 6 failures, the system checks which miners sent valid shares for the six failed blocks before mining the seventh block.

PPLNS ensures that the right miners are given their original share of rewards, rather than miners who are fond of pool-hopping. That said, this method depends a lot on pool luck—miners can earn huge profits when many blocks are mined in a day, but they can also end up earning nothing if the pool doesn’t mine any blocks.

Pool luck is calculated by taking the mean of (expected shares per round / actual shares per round).

Risk-averse miners generally do not prefer this method because the risk is effectively transferred onto the miners, while the pool operators take on limited risk.

FPPS (Full Pay-Per-Share): In FPPS, miners have two revenue streams: the block reward and the transaction fees (as opposed to PPS, in which the only revenue is the block reward).

The block reward is paid according to the PPS method, and the average transaction fee over the previous 24-hour cycle is calculated and distributed to miners.

PPS+ (Pay-Per-Share + Pay-Per-Last-N Share): In this method, the block reward is distributed according to the PPS method and the transaction fees are distributed according to the PPLNS method. This means that the pool’s actual transaction fees are distributed to miners based on how much hashrate they contributed in the last N shares.

After understanding pool payout schemes, miners should also calculate their mining economics by considering the fee percentage charged by pool operators. Generally, pools that use the FPPS method charge a higher percentage because they alleviate risk from the miners and assume it themselves. At the time of writing, f2pool uses the PPS+ method and charges a 2.5% fee.

Network statistics

Network hashrate is determined by the number of miners securing the Bitcoin network all over the world. An increase in the number of miners is directly proportional to an increase in hashrate.

Network difficulty in the Bitcoin network is hard coded with the stipulation that a block should be mined every 10 minutes on average. After every 2,016 blocks mined (~14 days), there is a difficulty adjustment that increases if blocks are being mined in less than 10 minutes on average and decreases if blocks are being mined in more than 10 minutes on average.

The bitcoin price fluctuates based on the supply and demand of BTC in the open market.

These three network parameters, together with the factors outlined above, play a crucial role in determining profits for Bitcoin miners.

Market sentiment

Market sentiment sometimes plays an outsized role in influencing Bitcoin mining profitability.

The historic bull run at the end of 2017 is one example of market sentiment leading to a higher BTC price and therefore higher miner profits. Though the historical track record of BTC as an asset is very short compared to assets like Treasury bonds and traditional stocks, it’s safe to say that the price of BTC is affected by market sentiment more than most other assets.

Taking into account all the factors that affect mining costs and revenues, it’s always a good time to start mining or hodling bitcoin. The hard part is knowing when to sell!